In The Spotlight

Mourad Younis, cloud and services provider segment leader, Schneider Electric, Middle East & Africa, explores new energy supply options for powering the continent’s data centres

Africa’s digital economy is scaling faster than its power systems. Cloud regions, artificial intelligence (AI) workloads, fintech, health platforms and government digitisation are all driving a wave of new data centres across the continent.

Yet too many of these facilities are still designed around a single assumption: when the grid fails, diesel will save the day. In an era of constrained grids, volatile fuel logistics and tightening Environmental, Social and Governance (ESG) expectations, this approach is no longer fit for purpose.

The reality on the ground is familiar to every African operator. Grid instability is the rule, not the exception. Voltage sags and swells, harmonics and frequency excursions threaten both IT uptime and cooling performance. Simply adding more protection devices does not solve the problem if operators cannot ‘see’ what is happening on their networks. Power quality visibility, through advanced metering and analytics, has become as strategic as server monitoring.

At the same time, capacity constraints on medium-voltage (MV) feeders and delays to substation upgrades are slowing down expansion from 5 - 20 MW starter sites to 50-100 MW and beyond. The risk is clear: if power infrastructure cannot scale at the same pace as digital demand, the continent’s cloud ambitions will stall.

Rethinking reliability: grid-to-chip, not genset-first

If Africa wants resilient, competitive and sustainable data centres, the starting point must be a grid-to-chip architecture rather than a genset-first mentality. That means treating the entire stack, from utility interconnection down to the rack, as a digitally-orchestrated system.

On the MV side, digital switchgear with built‑in protection and automation can isolate faults in milliseconds and enable self-healing topologies, improving uptime without brute-force redundancy. SF₆‑free switchgear technologies also remove a major greenhouse gas from the reliability equation while easing permitting for large campuses.

Closer to the IT load, high-efficiency, lithium-ion UPS systems are increasingly acting as both critical protection and grid assets. When combined with static transfer switches and modular low‑voltage distribution, they support selective coordination and enable facilities to ride through short disturbances without falling back on diesel. Layered on top, power quality meters and monitoring platforms provide analytics, alarms and compliance reporting that facility managers and regulators can trust.

This is not theory. Facilities that design for end‑to‑end selectivity, maintain total harmonic distortion below 5 %, keep power factor above 0.95 and hold voltage within a tight band at critical buses see fewer nuisance trips, smoother cooling performance and more predictable SLAs.

Cutting diesel dependence with data and automation

The biggest mindset shift is moving from ‘backup at all costs’ to ‘digital energy management’. Battery Energy Storage Systems (BESS) connected at MV level, combined with UPS ride‑through, can provide minutes to hours of autonomy for most grid events. When operators use microgrid controllers and energy management systems to orchestrate grid, PV, BESS and generators in real time, they can materially reduce fuel burn without compromising uptime.

In practice, this means:

• Using peak shaving and demand limiting to reduce generator starts and spinning reserve.

• Prioritising solar PV during the day to offset low‑voltage loads.

• Dynamically shedding non‑critical loads—such as some cooling or auxiliary systems—during severe events, using DCIM and BMS integration.

• Running UPS and power conditioning in carefully validated high‑efficiency modes while keeping power quality within strict limits.

Indicative results from such approaches show 30–60 % less generator runtime and 10–20 % reductions in energy-related OPEX, alongside substantial Scope 1 and Scope 2 emissions savings. For operators courting global hyperscalers and cloud service providers, those numbers are no longer ‘nice to have’ - they are part of the investment case.

Utilities and regulators: from constraint to collaborator

None of this happens in a vacuum. Utilities and regulators sit at the centre of whether Africa’s data centre boom will deepen grid stress or strengthen grid resilience. Too often, engagement with utilities starts late and focuses narrowly on connection capacity. That needs to change.

Early interconnection studies, joint protection coordination and clear roadmaps for 10 to 50 to 100 MW expansion should be standard for strategic digital sites. Data centres are uniquely positioned to offer grid services — reactive power support, fast frequency response and demand response using their UPS and storage fleets. If tariff structures, power purchase agreements and wheeling frameworks recognise this value, both sides win.

There is also a capability dimension. Co‑developed training on power quality standards, protection philosophies and digital operations can help utilities and operators converge on a common language. That collaboration is decisive in markets where policymakers see digital infrastructure as a lever for inclusive growth, but where grid investment will take years to catch up.

Design patterns for Africa’s digital decade

What does a practical roadmap look like? For many African markets, a phased approach makes sense.

Phase 1 (5–15 MW): Focus on power quality remediation, lithium‑ion UPS, modest PV penetration and 30–60 minutes of BESS, underpinned by SCADA visibility.

Phase 2 (15–40 MW): Grow PV to 30–40 % of daytime load, extend storage to 1–2 hours, introduce sophisticated microgrid control and enable demand response.

Phase 3 (40–100 MW): Build 2–4 hours of storage, leverage PPAs and wheeling, provide ancillary services to the grid and expand MV feeders with advanced, SF₆‑free switchgear.

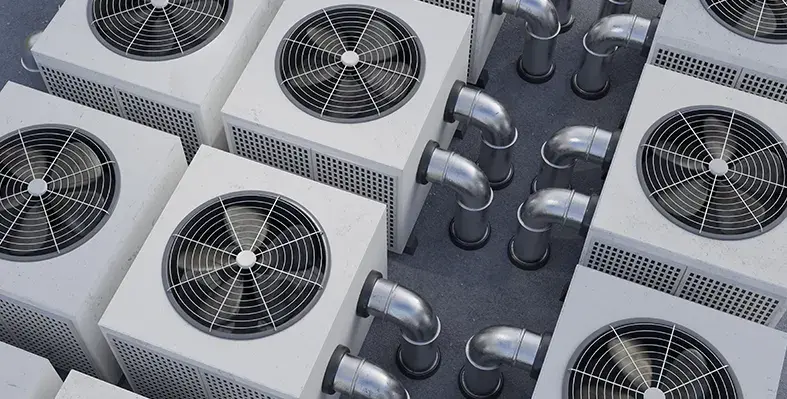

Across all phases, integrating cooling into the energy strategy is critical. Precision cooling with variable-speed drives, tied into building and energy management systems, can support load shifting and typically improves Power Usage Effectiveness (PUE) by 0.1 to 0.2 - margins that matter in hot climates and volatile grids.

Africa’s digital decade will be defined as much by electrons as by data. Those operators, policymakers and utilities that treat power as a strategic digital enabler, not just an engineering constraint, will shape where cloud regions land, where AI runs and which economies capture the value. Moving beyond diesel dependency towards hybrid, automated, sustainable energy systems is not only possible; it is now imperative for Africa’s data‑driven future.

Read more:

Vertiv launches CoolCenter immersion cooling system

Phoenix 30MW Ethiopian energy deal for data mine

Mitsubishi expands HVAC presence in Africa

Prinoth has officially launched its new flagship Panther T23r, describing it as the largest and most advanced rotating crawler carrier in the industry. The debut took place during a press conference at Conexpo-Conagg 2026

The Panther T23r is the first machine to incorporate Prinoth’s newly developed PowerForce undercarriage, an innovation that forms the basis of more than 20 patent applications. The system is engineered to significantly enhance terrain capability, operational efficiency and overall machine performance.

With a payload capacity of 22.5 short tons, the T23r combines high carrying capacity with relatively compact dimensions. The unit measures 9.8 feet wide, 10.8 feet tall and has a total weight of 40 tons. Its 360 degree continuous rotating upper structure, paired with a rounded Hardox steel dump box and telescopic cylinder, allows for precise material placement in confined or restricted worksites where traditional haulers may struggle to operate.

At the core of the machine’s performance is the PowerForce undercarriage. Unlike conventional rigid walking beam systems that transmit terrain shocks directly to the operator and payload, the new design absorbs ground irregularities while optimising power transfer. This enables improved travel speeds, reduced fuel consumption and greater operator comfort.

The Adaptive Independent Suspension System positions eight wheels on individual arms, each offering seven inches of travel supported by hydro-pneumatic shock absorbers. These automatically adapt to load variations, maintaining consistent ride quality whether the carrier is operating empty at 41,200 pounds or fully loaded at 85,400 pounds. 60% of the load is strategically distributed to the centre wheels, enhancing zero-turn manoeuvrability and lowering ground pressure.

Engineers have also introduced an oblong, oval-shaped track configuration that reduces bend points by 50% and doubles the bend radius compared to traditional systems. This approach minimises energy loss during each track cycle, ensuring more engine output is translated into forward motion. The expanded ground contact area further improves flotation in soft terrain and traction on inclines.

Precision track alignment is another defining feature, with pitch accuracy said to be ten times greater than standard crawler carriers. The system incorporates precise link spacing and an auto-centering “fox head” profile, enabling planetary drives to engage 15 teeth simultaneously instead of relying on single-point contact. The combined roller and wheel arrangement is designed to virtually eliminate de-tracking during demanding manoeuvres, reducing downtime and extending track life.

The undercarriage also benefits from an automatic dual-action tensioning system that continuously adjusts track tension according to operating conditions. When lightly loaded, tension is reduced to limit wear. Under heavier loads or when greater traction is required, tension increases automatically. This real-time adjustment is intended to maximise performance while prolonging service life.

The Panther T23r’s dump box has been redesigned with a rounded, deep-section Hardox steel profile to support smoother material discharge and minimise carryback, particularly when handling sticky soils or aggregates. The box has been repositioned closer to the undercarriage centreline, improving centre of gravity and balancing loads across the suspension and central bearing. This refinement helps lower structural stress and overall frame complexity.

The machine is equipped with a newly designed cab featuring a near centre-mounted operator seat for improved visibility, especially to the right side where ground crews typically operate. Standard features include an air-ride seat, 7 inch touchscreen display, ergonomic joystick controls for dumping and rotation, intuitive steering wheel and foot throttle system, sun visor and cruise control to reduce fatigue over long shifts. An optional buddy seat is available.

“Customers are pushing farther into remote, sensitive and high-consequence environments,” said Frank M Gangi, product manager for the Prinoth Panther. “With the Panther T23r, we set out to give them a machine that feels completely in control on those sites, with a payload and undercarriage that lets them haul more in fewer passes while protecting the jobsite and the machine.”

A public unveiling ceremony will take place on Tuesday, March 3 at 4:30 PM PST at the Prinoth booth #W43845 in the West Hall of the Las Vegas Convention Center. The Panther T23r will remain on display at the booth from March 3 to 7.

-

-

In the final webinar of its African Review-hosted 2023 campaign, Convergent Group explored its modern, eco-friendly concrete solutions for African projects

Such solutions – delivered to cut maintenance costs by eliminating hazardous silicate products – were showcased by company experts in the form of Jean-Claude Biard, SEO of Convergent Group SA; Mputu Schmidt, former CEO of Convergent Group SA and founder of Bondeko MB (exclusive distributor of Convergent Group in Africa); Carlos Garcia, technical and sales for ADI Group (Spanish distributor for Convergent Group); and Amritpal Singh Sura, external consultant for flooring treatments, former distributor of Convergent products in the Middle East.

“A number of projects we were doing in the Middle East required protection,” remarked Sura. “Longevity of protection requires a system which basically impregnates and becomes a densified surface as opposed to something which is topical and lifts off due to moisture migration. I found that being exposed to Convergent, it was important to stay focused on those systems in the Middle East. Jean-Claude, Mputu and I met several times in Dubai and there was emphasis on providing systems which were affordable and still ending up having a robust, lasting longevity of product. So you are not spending money all the time in order to maintain the finishes which you have already paid for.”

Over the course of the session, the participants guided the audience through the potential of cutting-edge lithium silicate technology for enhancing the protection of concrete surfaces, maximising cost-effectiveness and meeting sustainability targets.

-

In a comprehensive webinar hosted by African Review, a panel of professionals associated with Convergent Group explored new generation lithium silicate technology and why it is emerging as the optimum solution for concrete floor protection.

Robert Daniels, editor of African Review, was joined by Jean-Claude Biard, CEO of Convergent Group; Mputu Schmidt, former CEO of Convergent and founder of Bondeko MB, an exclusive distributor of Convergent; Hicham Sofyani, president of Texol; Carlos Garcia, technical and sales for ADI Group; and Marc Puig, commercial manager of Comace Import.

Each providing a unique angle, the panellists combined to provide a masterclass around concrete treatments and the increasing challenges around them, explaining to attendees how to choose the right formula for their requirements and touching on issues such as why lithium densifiers are better than sodium and potassium densifiers.

Throughout the session, those watching were treated to informative case studies showcasing how Convergent eco-friendly products are increasing abrasion resistance, raising ease of maintenance, and ensuring the highest quality gloss retention.

By the end of the webinar, a majority of attendees (many of which had not had much experience with Convergent) expressed their interest in using the company’s new generation lithium silicate technology with the rest indicating their desire to learn more about Convergent and its products. Watch the webinar, in full, to discover why viewers were convinced and learn more about advanced floor care solutions for your operations.

-

Presenting on an African Review-hosted webinar, Martin Provencher, global industry principal for mining, metals and materials at AVEVA, explored the digital transformation of mining operations and its impact on sustainability.

“Sustainability is becoming a key aspect for mining operations,” remarked Provencher. “If we look at the latest EY research on the top ten business risks and opportunities for mining and metals globally in 2023, ESG remains at the top. Of course, most companies have environmental goals or are expected to reach a net zero emission by 2050, which is a pretty aggressive target. Many of them are targeting 30% reduction by 2030; seven years from now. So there is a lot of action that needs to take place quickly to get there. It is possible to get there, but we need to make sure we are doing this correctly.”

Fast becoming a huge part of ESG initiatives is fleet electrification where particular progress is being made in underground mines. While some countries are certainly more advanced than others here, Provencher noted that 40% of total emissions from the mining industry come from diesel trucks, making EVs a very attractive low-hanging fruit for companies to pursue.

There are, however, a number of challenges associated with bringing in electric vehicles which remains a barrier for introduction. One of the predominant reasons, is the limited range of EVs against diesel counterparts. To mitigate this, Provencher continued, data management is key and ensuring a strong grasp of real-time information coming in will show operators when machinery needs to be charged, allowing them to plan effectively for maximum efficiency on site.

Indeed, this is but a small advantage that digitalisation can bring to the mining industry as it grapples to meet ESG goals while achieving production targets. By getting a better grip of their data and using it to empower tools such as artificial intelligence, advanced analytics and machine learning, companies can achieve tangible benefits such as reduce downtime, enhance worker safety, cut operating costs and, of course, ensure compliance with environmental regulations and targets.

Through the course of the webinar, Provencher outlined this in more detail and explored AVEVA’s suite of cutting-edge software solutions, specifically designed to help mining companies make progress on their digitalisation journey and empower their operations.

Watch the full webinar, completed with detailed case studies and an insightful Q&A session.

-

-

-

Convergent, in association with African Review, has held a detailed webinar exploring the usage and effectiveness of lithium silicates and densifiers over traditional methods of concrete surface management which often struggle to meet the increasing challenges posed by concrete surface management.

Convergent experts including Mputu Schmidt, CEO of Convergent; Carlos Garcia, product manager end-user solutions, construction chemicals, Spain and Portugal for the RD Group; Matteo Mozzarelli, CEO of concrete Solutions Italia; and Jean-Claude Biard, global senior executive for the Convergent Group, presented across the session.

Together, they delved into the latest cost-effective application methods for long lasting finishing of concrete that can help reduce maintenance costs and avoid unexpected repair action. In addition, they examined the advancements in technologies that can sustain increased abrasion resistant stains and ensure gloss retention to the highest quality.

As part of the webinar, the representatives explored case studies including a case in DRC where a medical centre had been constructed with a low-quality concrete floor. The customer was considering completely replacing the floor but instead, Convergent put forward a special treatment with its 244+ Pentra-Sil lithium hardener, densifier and sealer. With this solution, Convergent can increase the hardness of a surface by up to 40% and therefore saved the customer significant recuperation costs over a complete replacement. Convergent were happy to report that the solution was perfect for the facility and the customer was pleased to avoid the extra construction work that would have been required for a complete replacement.

Watch the full webinar, including more information about Convergent’s innovative solutions.

Lyra Energy has reached financial close on the 255MW Thakadu solar power project in South Africa

It has also commenced construction of the facility, located on the border of South Africa's Free State and North West provinces.

Lyra is a renewable energy partnership between Scatec, Standard Bank and Stanlib.

“This marks an important milestone for Lyra Energy and the Thakadu project,” said Scatec CEO Terje Pilskog.

“With contracted private sector offtake in place and financing secured, the project is well positioned for construction and delivery.”

The project will be built in two phases, with construction of the first phase now commencing.

The second phase is expected to start construction in the second half of 2026.

The total capital expenditure for the project is approximately ZAR 4bn (US$240mn) and will be financed by a combination of non-recourse project debt and equity from the owners, with a target leverage of 80%.

The senior lender is Standard Bank of South Africa.

Scatec will provide Engineering, Procurement and Construction (EPC), Asset Management (AM) and Operations & Maintenance (O&M) services for the project.

Its EPC-scope corresponds to approximately 80% of total capex.

Commercial operations date for the first phase is expected in the first half of 2027.

Read more:

Nigeria onsite power delivered by Jubaili Bros

Beyond diesel: rethinking power for Africa's data centres

Trafo Power Solutions designs scalable mining infrastructure

The rebuilt Sandvik hydraulic hammer is ready for installation at site. (Image source: Sandvik Rock Processing)

Sandvik Rock Processing has finalised a comprehensive OEM-level refurbishment of a Sandvik BR3288i hydraulic breaker and a Sandvik BB8094R breaker boom for a leading gold mining operation in Ghana

The project restored a key component of the site’s primary crushing circuit, with the rebuild, reinstallation and commissioning delivering measurable gains in equipment availability and output. Ongoing quarterly inspections and technical support from the company’s Kumasi-based team continue to reinforce performance.

The refurbishment was carried out at Sandvik Rock Processing’s fully equipped workshop in Kumasi. The breaker and boom assembly are installed at the mine’s run-of-mine grizzly, where oversized rocks generated during blasting are reduced to prevent blockages and maintain smooth material flow into the crusher.

“This project restored a vital asset that plays a central role in the mine’s primary crushing circuit,” commented Amos Fordjour, senior service technician at Sandvik Rock Processing. “Our extensive rebuild has returned the machine to OEM performance standards, significantly improving the mine’s reliability and production continuity.”

After more than five years in operation, the equipment was scheduled for refurbishment. Work commenced on site, where the 11 tonne boom assembly was dismantled using the mine’s crane infrastructure before being transported over a three-hour journey to the Kumasi workshop.

“Once in the workshop, our technicians stripped the units completely - checking for critical components such as pins, bushings, cylinder seals and mounting brackets that required replacement,” remarked Fordjour. “The boom was sandblasted and inspected for cracks, the hydraulic cylinders were rebuilt and pressure-tested and the hammer was fully refurbished.”

Haqq Abdul Rahman, graduate technician at Sandvik Rock Processing, highlighted the importance of parts availability in reducing turnaround times. He explained that mines frequently face challenges with oversized rocks at the run-of-mine grizzly, and temporary mobile breakers often require considerably more time to handle the material.

“It was important that we controlled the turnaround time on this project so the mine could put the equipment back to work as soon as possible,” said Rahman. “This particular unit breaks oversized rocks much faster than the smaller mobile units that the mine had to rely on while this one was being refurbished.”

The Sandvik BB8094R breaker boom, rated at 55 kW input power, provides a maximum reach of 12.7 m, with nominal horizontal and vertical reaches of 9.8 m and 9 m respectively, and a full 360° swing capability. The 2.3 tonne Sandvik BR3288i hydraulic breaker incorporates an operating principle that optimises stroke length, blow energy and includes an idle blow protector, enabling adaptability across applications while enhancing hydraulic efficiency and operational safety.

Fordjour underscored the role of strict quality control procedures throughout the refurbishment.

“We follow strict operating procedures and standards in everything we do,” continued Rahman. “This includes using only genuine Sandvik parts which allows us to guarantee the quality of both the components and the workmanship.”

Following workshop completion, Sandvik Rock Processing teams returned to site for installation and commissioning. The three-week process required detailed coordination around crane usage, electrical integration, positioning and safety compliance.

“We work very closely with customers during removal, installation and commissioning,” Fordjour noted. “In this case, the mine provided the cranes and support equipment and we handled all the technical work; that collaboration is critical.”

Rahman explained that the restored boom and breaker now offer enhanced structural integrity, precise OEM clearances and improved swing performance, supporting efficient energy transfer and high twist resistance under demanding impact conditions.

“For the mine, the biggest impact is uptime and production,” said Rahman. “Without this breaker, their crushing circuit slows down considerably; now that it is back to full performance and production is consistent again.”

Post-commissioning support remains ongoing, with Sandvik Rock Processing conducting quarterly inspections to assess pins, seals and overall structural condition, while maintaining readiness for service interventions whenever required.

RFQ marks first step in private sector participation process to strengthen operations and attract private investment

Transnet SOC Ltd has released a Request for Qualification to begin identifying a private sector partner for its Private Sector Participation project at the Richards Bay Dry Bulk Terminal

The RFQ marks a significant step under Transnet’s Reinvent for Growth Strategy and reflects its intention to formally engage the market to enhance operational efficiency, secure private investment and reinforce the long-term sustainability of South Africa’s freight and logistics network.

The Richards Bay Dry Bulk Terminal serves as a vital export hub for bulk commodities, especially chrome and magnetite. Through the PSP initiative, Transnet aims to harness private sector capital and operational expertise to strengthen reliability and efficiency, enable future capacity expansion and maintain strategic control of the asset.

In addition, the project is expected to create opportunities linked to supplier development, local participation and community upliftment, particularly in the Richards Bay area.

As the first stage of the selection process, the RFQ calls on interested bidders to demonstrate their technical expertise, operational track record, financial strength and compliance with Transnet’s stipulated requirements. Applicants must also present clear and measurable proposals detailing how they will advance community upliftment through the PSP arrangement. Parties that satisfy the qualification criteria may progress to a subsequent Request for Proposal phase.

Transnet has emphasised that the PSP process will be managed transparently and competitively, in full alignment with applicable governance standards and regulatory obligations. Ongoing engagement with key stakeholders, including employees, organised labour and government, will remain central throughout the process.

Africa Finance Corporation (AFC) confirmed its advisory role in a recent landmark bond issue that aims to resolve many of the deep-rooted problems that have long blighted Nigeria’s power sector

The Nigeria’s government recently issued N501bn (US$358mn) as the inaugural tranche of the N4 trillion (US$2.9bn) power sector bond programme under the Presidential Power Sector Financial Reforms Programme (PPSFRP).

The initiative is designed to resolve more than a decade of legacy debts that have constrained liquidity, discouraged investment and weakened confidence across the electricity value chain.

It forms an integral part of sweeping power sector reforms, marking a major step toward restoring financial stability in the electricity market.

The bond programme will be used to settle verified outstanding receivables owed to power generation companies for electricity supplied between February 2015 and March 2025.

By clearing arrears, the government aims to reset the financial foundation of the power market and strengthen the balance sheets of the generating firms.

“The successful issuance of the inaugural tranche under the power sector bond programme underscores AFC’s commitment to supporting transformative reforms in Nigeria’s power sector,” said Banji Fehintola, executive board member and head, financial services at AFC.

“By resolving long-standing liquidity challenges and restoring confidence among investors and operators, this transaction lays the foundation for sustainable growth and improved electricity supply across the country.”

AFC acted as co-financial adviser, providing support on programme design, negotiation strategy, settlement agreements with the generating companies and the structuring of the bond issuance.

The transaction mobilised significant domestic capital, with pension fund administrators accounting for roughly half of the total financing, highlighting growing local investor confidence in the reform agenda.

Officials say the programme goes beyond debt resolution and forms part of a broader package of power sector reforms that includes investments in transmission infrastructure, accelerated rollout of consumer metering and a transition toward bilateral electricity trading based on market-reflective pricing.

Together, the measures are intended to create a more transparent, commercially viable and sustainable electricity market.

When fully implemented, the programme is expected to impact about 5,398MW of generation capacity and settle payments for more than 290,000GWh of electricity supplied over the past decade, benefiting companies serving around 12 million registered customers nationwide.

The bond programme is a major step towards reviving Nigeria’s electricity sector, according to Olu Verheijen, special advisor to the president on energy.

“The programme represents a decisive reset of Nigeria’s electricity market, combining debt resolution with broader financial and structural reforms,” said Verheijen.

“AFC brought strong sector expertise, deep local market knowledge and a clear understanding of the market’s commercial complexities, playing a critical role in delivering a credible outcome that supports liquidity restoration, investor confidence and long-term sustainability.”

Read more:

Africa's flaring problem: less waste, more megawatts

A new report from management consultancy Arthur D. Little warns that rising product portfolio complexity is quietly eroding profitability in the manufacturing sector, constraining digital growth, and limiting operational flexibility.

The study, Rise of Complexity in Manufacturing, highlights that companies must take decisive action to simplify their offerings and leverage modularisation to stay competitive.

“Unchecked complexity is a silent profitability killer,” the report states. “With resources limited and markets increasingly commoditised, companies must reduce product portfolio complexity to drive profitability and innovation.”

Manufacturers often expand product variants to meet customer demand, but without systematic portfolio pruning, these efforts generate hidden costs. Non-customer-facing complexity such as outdated products, excessive SKUs, and intricate internal processes can slow development, reduce scalability, and impede time to market.

The report identifies four key challenges for manufacturers: maintaining profitability amid market commoditisation, differentiating through digital solutions, ensuring supply chain resilience, and balancing legacy systems with emerging technologies such as new materials, battery-powered engines, or alternative fuels.

Arthur D. Little recommends a data-driven approach to complexity, starting with measuring the cost of complexity (CoC) across product lines and functions. A monetary proxy for CoC can capture inefficiencies in development, manufacturing, warehousing, and support, helping firms identify underperforming products for phaseout.

Strategic modularisation is highlighted as a crucial tool for managing complexity. By designing standardised, interchangeable product modules, manufacturers can simplify portfolios, accelerate time to market, and reduce costs while enabling cost-effective customisation.

The report cites Electrolux, which cut component numbers by 40% and reduced development time by 30% through modular design, and Siemens, which applied modularity to its industrial automation systems, reducing design time by 40% and improving scalability.

Arthur D. Little stresses that complexity reduction requires more than technical solutions: it demands cross-functional coordination, strong governance, and a cultural shift away from short-term gains. Companies must embed modular principles in product development, eliminate low-performing products, and ensure that both hardware and software systems are designed with simplicity in mind.

“Reducing product portfolio complexity is not a technical fix — it is a strategic transformation,” the report concludes. “By making complexity measurable, pruning underperforming products, and embedding modular design, manufacturers can release trapped value, improve speed to market, and build more resilient operations.”

The consultancy urges manufacturers to act decisively now, turning awareness of complexity into structured strategies for long-term profitability and innovation.