Mourad Younis, cloud and services provider segment leader, Schneider Electric, Middle East & Africa, explores new energy supply options for powering the continent’s data centres

Africa’s digital economy is scaling faster than its power systems. Cloud regions, artificial intelligence (AI) workloads, fintech, health platforms and government digitisation are all driving a wave of new data centres across the continent.

Yet too many of these facilities are still designed around a single assumption: when the grid fails, diesel will save the day. In an era of constrained grids, volatile fuel logistics and tightening Environmental, Social and Governance (ESG) expectations, this approach is no longer fit for purpose.

The reality on the ground is familiar to every African operator. Grid instability is the rule, not the exception. Voltage sags and swells, harmonics and frequency excursions threaten both IT uptime and cooling performance. Simply adding more protection devices does not solve the problem if operators cannot ‘see’ what is happening on their networks. Power quality visibility, through advanced metering and analytics, has become as strategic as server monitoring.

At the same time, capacity constraints on medium-voltage (MV) feeders and delays to substation upgrades are slowing down expansion from 5 - 20 MW starter sites to 50-100 MW and beyond. The risk is clear: if power infrastructure cannot scale at the same pace as digital demand, the continent’s cloud ambitions will stall.

Rethinking reliability: grid-to-chip, not genset-first

If Africa wants resilient, competitive and sustainable data centres, the starting point must be a grid-to-chip architecture rather than a genset-first mentality. That means treating the entire stack, from utility interconnection down to the rack, as a digitally-orchestrated system.

On the MV side, digital switchgear with built‑in protection and automation can isolate faults in milliseconds and enable self-healing topologies, improving uptime without brute-force redundancy. SF₆‑free switchgear technologies also remove a major greenhouse gas from the reliability equation while easing permitting for large campuses.

Closer to the IT load, high-efficiency, lithium-ion UPS systems are increasingly acting as both critical protection and grid assets. When combined with static transfer switches and modular low‑voltage distribution, they support selective coordination and enable facilities to ride through short disturbances without falling back on diesel. Layered on top, power quality meters and monitoring platforms provide analytics, alarms and compliance reporting that facility managers and regulators can trust.

This is not theory. Facilities that design for end‑to‑end selectivity, maintain total harmonic distortion below 5 %, keep power factor above 0.95 and hold voltage within a tight band at critical buses see fewer nuisance trips, smoother cooling performance and more predictable SLAs.

Cutting diesel dependence with data and automation

The biggest mindset shift is moving from ‘backup at all costs’ to ‘digital energy management’. Battery Energy Storage Systems (BESS) connected at MV level, combined with UPS ride‑through, can provide minutes to hours of autonomy for most grid events. When operators use microgrid controllers and energy management systems to orchestrate grid, PV, BESS and generators in real time, they can materially reduce fuel burn without compromising uptime.

In practice, this means:

• Using peak shaving and demand limiting to reduce generator starts and spinning reserve.

• Prioritising solar PV during the day to offset low‑voltage loads.

• Dynamically shedding non‑critical loads—such as some cooling or auxiliary systems—during severe events, using DCIM and BMS integration.

• Running UPS and power conditioning in carefully validated high‑efficiency modes while keeping power quality within strict limits.

Indicative results from such approaches show 30–60 % less generator runtime and 10–20 % reductions in energy-related OPEX, alongside substantial Scope 1 and Scope 2 emissions savings. For operators courting global hyperscalers and cloud service providers, those numbers are no longer ‘nice to have’ - they are part of the investment case.

Utilities and regulators: from constraint to collaborator

None of this happens in a vacuum. Utilities and regulators sit at the centre of whether Africa’s data centre boom will deepen grid stress or strengthen grid resilience. Too often, engagement with utilities starts late and focuses narrowly on connection capacity. That needs to change.

Early interconnection studies, joint protection coordination and clear roadmaps for 10 to 50 to 100 MW expansion should be standard for strategic digital sites. Data centres are uniquely positioned to offer grid services — reactive power support, fast frequency response and demand response using their UPS and storage fleets. If tariff structures, power purchase agreements and wheeling frameworks recognise this value, both sides win.

There is also a capability dimension. Co‑developed training on power quality standards, protection philosophies and digital operations can help utilities and operators converge on a common language. That collaboration is decisive in markets where policymakers see digital infrastructure as a lever for inclusive growth, but where grid investment will take years to catch up.

Design patterns for Africa’s digital decade

What does a practical roadmap look like? For many African markets, a phased approach makes sense.

Phase 1 (5–15 MW): Focus on power quality remediation, lithium‑ion UPS, modest PV penetration and 30–60 minutes of BESS, underpinned by SCADA visibility.

Phase 2 (15–40 MW): Grow PV to 30–40 % of daytime load, extend storage to 1–2 hours, introduce sophisticated microgrid control and enable demand response.

Phase 3 (40–100 MW): Build 2–4 hours of storage, leverage PPAs and wheeling, provide ancillary services to the grid and expand MV feeders with advanced, SF₆‑free switchgear.

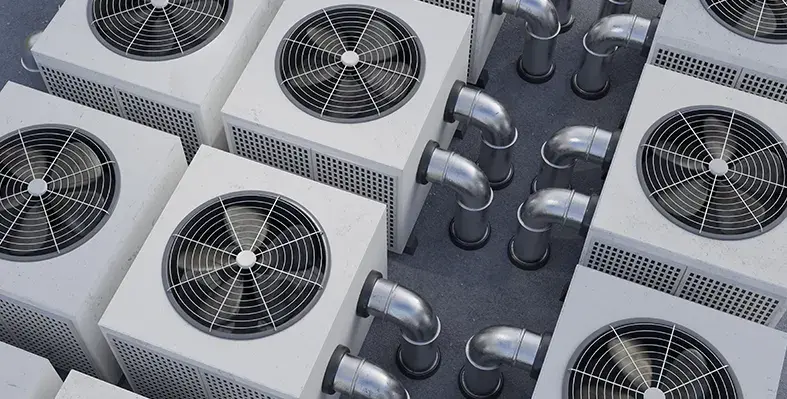

Across all phases, integrating cooling into the energy strategy is critical. Precision cooling with variable-speed drives, tied into building and energy management systems, can support load shifting and typically improves Power Usage Effectiveness (PUE) by 0.1 to 0.2 - margins that matter in hot climates and volatile grids.

Africa’s digital decade will be defined as much by electrons as by data. Those operators, policymakers and utilities that treat power as a strategic digital enabler, not just an engineering constraint, will shape where cloud regions land, where AI runs and which economies capture the value. Moving beyond diesel dependency towards hybrid, automated, sustainable energy systems is not only possible; it is now imperative for Africa’s data‑driven future.

Read more:

Vertiv launches CoolCenter immersion cooling system

Phoenix 30MW Ethiopian energy deal for data mine

Mitsubishi expands HVAC presence in Africa