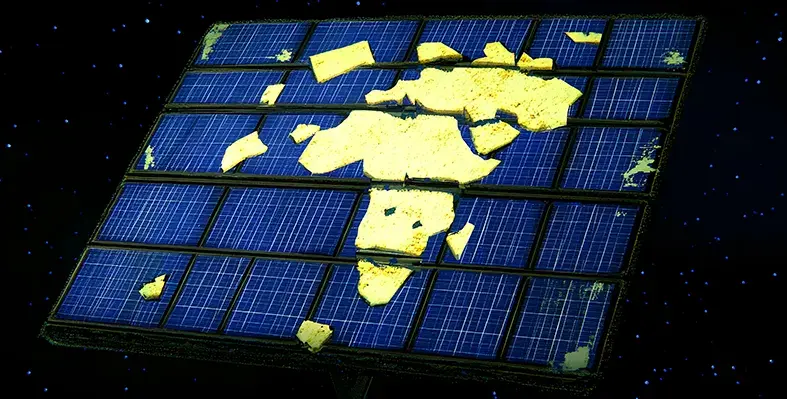

MSC is drawing attention to the scale and reach of its intermodal logistics solutions across Africa, illustrating how the integration of rail, road and port infrastructure is reshaping inland cargo movement

By extending connectivity well beyond coastal ports, MSC is helping customers access critical hinterland markets with greater reliability, efficiency and control.

Intermodal transport has become a cornerstone of resilient supply chains across the continent. By reducing transit times, improving schedule predictability and strengthening links between landlocked economies and global trade routes, integrated inland solutions are responding to a growing need for dependable connectivity. MSC’s expanded intermodal offering is designed to meet this demand, providing customers with flexible, end-to-end transport options that support long-term planning and operational stability.

Abidjan–Ouagadougou: A strategic rail corridor

The first feature in the series focuses on the rail corridor linking Côte d’Ivoire and Burkina Faso, one of West Africa’s most active trade routes. Stretching approximately 1,150–1,260 km between the Port of Abidjan and Ouagadougou, the rail connection offers a reliable inland alternative to road transport, helping to ease congestion and create more consistent cargo flows.

Serving key sectors including agriculture, FMCG, mining and temperature-controlled cargo, the corridor enables customers to move goods inland with greater security and predictability. Through MSC’s intermodal network, shippers benefit from stable inland-to-port connectivity, improved transit time consistency and the confidence to plan operations year-round.

Building value across Africa’s key trade lanes

Beyond the Côte d’Ivoire–Burkina Faso rail link, the series will highlight other corridors where MSC’s intermodal solutions are delivering measurable value for customers.

In Cameroon, the focus turns to cargo flows supported by Kribi Port and improved trucking routes, which are strengthening access to inland markets and streamlining trade connections.

Across South Africa and Namibia, MSC’s trucking network is enabling dependable cross-border transport, with particular emphasis on reefer cargo supported by the Durban reefer warehouse, ensuring temperature integrity throughout the journey.

In Kenya, the spotlight follows agricultural exports from origin to port, offering a full view of how MSC’s integrated inland network supports a seamless land-to-port logistics chain.

Together, these corridors reflect MSC’s commitment to building predictable inland transport solutions that reduce operational complexity, enhance supply chain visibility and connect African markets more efficiently to global trade.