In The Spotlight

Hitachi Energy has completed a project to connect Tanzania’s leading gold producer, Geita Gold Mine Limited (GGML), to the national grid, displacing the use of traditional thermal gensets for energy

In a statement, Hitachi Energy said the project replaced 80% of the fossil-fuel gensets used by GGML for power generation and is expected to reduce the site’s carbon emissions by at least 50 kilotons (Kt) CO2 per annum.

Tanzania’s national grid is currently estimated to be made up of around 45.5% renewable energy sources.

“We are proud to support Geita Gold Mine Limited in this landmark achievement,” said Mohamed Hosseiny, managing director at Hitachi Energy in Africa.

AngloGold Ashanti, the owner of GGML, collaborated with the Tanzanian government, power utility Tanzania Electric Supply Company (Tanesco), and Hitachi Energy to execute the project.

As part of the deployment, Hitachi Energy delivered a state-of-the-art power electronic converter that stabilises the mine’s connection to the grid, featuring a PCS 6000 STATCOM system.

The system’s performance is further optimised through MicroSCADA, which provides crucial real-time monitoring and control.

The PCS 6000 STATCOM system was pre-assembled, tested to the highest standards, and shipped as a containerised package for fast installation on-site.

Its compact design and adaptability to harsh mining environments make it a “compelling solution” for industrial and remote grid applications, according to Hitachi Energy.

“Electrification solutions, like the STATCOM system, are vital to accelerating the global energy transition,” a statement read.

“By delivering innovative technology to high-impact markets, Hitachi Energy empowers the world’s energy system to be more sustainable, secure, resilient, and affordable.”

During the project execution, the company engaged with local partners, providing supervision and training to contractors and skills development.

Hosseiny added that it underlined the industry’s commitment to improving its environmental footprint.

“AngloGold Ashanti’s unwavering commitment to sustainability and climate resilience across their business, value chain, and communities sets a remarkable standard in the industry,” he said.

“It is reassuring that our pioneering technologies and solutions are advancing a sustainable energy future for all.”

Read more:

Wartsila signs gold mine power deal in Senegal

Etihad Cargo introduces SmartTrack, offering real-time shipment visibility, proactive alerts, and a customer-centric digital dashboard worldwide. (Image source: Etihad Cargo)

Etihad Cargo, the logistics and cargo division of Etihad Airways, has officially introduced SmartTrack, a premium shipment visibility service that allows customers to monitor their cargo in real time

First unveiled earlier this year at Air Cargo Europe 2025 in Munich, SmartTrack is now accessible globally through the Etihad Cargo website. This makes Etihad Cargo the first air cargo carrier to offer such advanced smart tracking technology to customers worldwide.

Delivering unmatched shipment transparency

SmartTrack provides live location updates and condition monitoring throughout the supply chain. Using cellular, GPS, and Wi-Fi connectivity, it sends instant alerts for temperature, humidity, shock, tilt, and light events, ensuring greater reliability and proactive risk management.

To support customers further, Etihad Cargo has launched a 24/7 SmartTrack Control Centre, offering live case tracking, alert prioritisation, and actionable workflows for real-time intervention, repair, and resolution.

A streamlined digital experience

The accompanying customer dashboard provides a single, intuitive interface for monitoring shipments. Accessible via secure single sign-on on both mobile and web platforms, it allows users to:

-

Track shipments in real time by AWB, origin, destination, or product type

-

Monitor live sensor data and receive proactive SLA notifications

-

Access custody chain insights covering pre- and post-Etihad Cargo handling

-

Receive instant alerts on milestone delays, geofence violations, and temperature excursions

-

Cutting-Edge Technology in Action

SmartTrack was developed in partnership with Tag-N-Trac, integrating booking data, sensor events, and geofence alerting to create a seamless customer experience.

Stanislas Brun, chief cargo officer at Etihad Airways, said, “SmartTrack marks a major step forward in the way we support our customers. By integrating simplicity, intelligence and automation, we are providing greater confidence and control over shipments while setting a new benchmark for transparency in the industry. This innovation reflects Etihad Cargo’s broader vision: to harness digital transformation in order to deliver smarter, more resilient, and more customer-centric logistics solutions.”

Driving the future of digital cargo

SmartTrack is part of Etihad Cargo’s broader digital roadmap, focusing on innovation, operational excellence, and customer satisfaction. By combining real-time tracking, round-the-clock monitoring, and a customer-focused design, the airline continues to solidify its position as a global leader in air freight innovation.

MaxiCharger DC Fast units installed by Autel Energy at Cape Town’s Arrowgate Depot, forming the backbone of South Africa’s largest EV bus charging hub with capacity to expand to 50 chargers and 120 buses by 2025. (Image source: Autel Energy)

Autel Energy is ramping up plans for the electrification of Cape Town’s bus fleet with the deployment of its advanced MaxiCharger DC Fast (150–240 kW) technology

A leader in smart and sustainable electric vehicle (EV) charging solutions, the company is powering South Africa’s largest public EV bus charging hub — also among the most significant in Africa — enabling the rollout of 120 electric buses by December 2025.

The project, delivered in partnership with STS Tech Group, is centred at Cape Town’s Arrowgate depot, which operates on a solar–grid hybrid system.

This integration highlights Autel Energy’s capability to deliver charging infrastructure that is both renewable-ready and future-proof, ensuring maximum uptime, high efficiency, and long-term sustainability, the company reported in a statement.

“This project in Cape Town is a milestone not only for Africa but for the global transition to clean mobility,” said Kemin Zuo, regional director of Autel IMEA DMCC.

Currently, the Arrowgate depot operates with 30 MaxiCharger DC Fast units, with capacity expanding to 50 units by year-end.

These chargers support the city’s 68 BYD B12 electric buses already in operation — each carrying 65 passengers with a range of up to 240 km per charge — and will scale to serve 120 buses by the end of 2025.

This transition will eliminate an estimated 18,000 tonnes of CO2 emissions annually, equivalent to removing more than 4,000 cars from the city’s roads.

The landmark project also supports Cape Town’s clean mobility ambitions and South Africa’s broader sustainability goals, providing citizens with cleaner air, quieter transport, and reliable daily mobility.

With over 1 million chargers shipped in over 70 countries, Autel Energy’s DC charging solutions span from 50 kW DC fast chargers to 1.44 megawatt-level ultra-fast systems, serving residential, commercial, fleet and heavy-duty transport applications.

“At Autel Energy, our mission is to accelerate EV adoption by delivering charging solutions that are intelligent, scalable, and renewable-ready,” said Zuo.

“By enabling seamless integration with renewable energy sources such as solar and wind across our entire charging portfolio, we demonstrate how cities can build future-proof infrastructure that reduces emissions while ensuring reliable public transport.”

Zuo added: “Africa is a strategic region for e-mobility growth, and we are proud to play a central role in shaping its sustainable transport future.”

Read more:

Western Cape rolls out new BYD electric buses

Scatec pioneers industrial EV adoption on site in Northern Cape

Transforming Africa's transport through electric collaboration

-

-

In the final webinar of its African Review-hosted 2023 campaign, Convergent Group explored its modern, eco-friendly concrete solutions for African projects

Such solutions – delivered to cut maintenance costs by eliminating hazardous silicate products – were showcased by company experts in the form of Jean-Claude Biard, SEO of Convergent Group SA; Mputu Schmidt, former CEO of Convergent Group SA and founder of Bondeko MB (exclusive distributor of Convergent Group in Africa); Carlos Garcia, technical and sales for ADI Group (Spanish distributor for Convergent Group); and Amritpal Singh Sura, external consultant for flooring treatments, former distributor of Convergent products in the Middle East.

“A number of projects we were doing in the Middle East required protection,” remarked Sura. “Longevity of protection requires a system which basically impregnates and becomes a densified surface as opposed to something which is topical and lifts off due to moisture migration. I found that being exposed to Convergent, it was important to stay focused on those systems in the Middle East. Jean-Claude, Mputu and I met several times in Dubai and there was emphasis on providing systems which were affordable and still ending up having a robust, lasting longevity of product. So you are not spending money all the time in order to maintain the finishes which you have already paid for.”

Over the course of the session, the participants guided the audience through the potential of cutting-edge lithium silicate technology for enhancing the protection of concrete surfaces, maximising cost-effectiveness and meeting sustainability targets.

-

In a comprehensive webinar hosted by African Review, a panel of professionals associated with Convergent Group explored new generation lithium silicate technology and why it is emerging as the optimum solution for concrete floor protection.

Robert Daniels, editor of African Review, was joined by Jean-Claude Biard, CEO of Convergent Group; Mputu Schmidt, former CEO of Convergent and founder of Bondeko MB, an exclusive distributor of Convergent; Hicham Sofyani, president of Texol; Carlos Garcia, technical and sales for ADI Group; and Marc Puig, commercial manager of Comace Import.

Each providing a unique angle, the panellists combined to provide a masterclass around concrete treatments and the increasing challenges around them, explaining to attendees how to choose the right formula for their requirements and touching on issues such as why lithium densifiers are better than sodium and potassium densifiers.

Throughout the session, those watching were treated to informative case studies showcasing how Convergent eco-friendly products are increasing abrasion resistance, raising ease of maintenance, and ensuring the highest quality gloss retention.

By the end of the webinar, a majority of attendees (many of which had not had much experience with Convergent) expressed their interest in using the company’s new generation lithium silicate technology with the rest indicating their desire to learn more about Convergent and its products. Watch the webinar, in full, to discover why viewers were convinced and learn more about advanced floor care solutions for your operations.

-

Presenting on an African Review-hosted webinar, Martin Provencher, global industry principal for mining, metals and materials at AVEVA, explored the digital transformation of mining operations and its impact on sustainability.

“Sustainability is becoming a key aspect for mining operations,” remarked Provencher. “If we look at the latest EY research on the top ten business risks and opportunities for mining and metals globally in 2023, ESG remains at the top. Of course, most companies have environmental goals or are expected to reach a net zero emission by 2050, which is a pretty aggressive target. Many of them are targeting 30% reduction by 2030; seven years from now. So there is a lot of action that needs to take place quickly to get there. It is possible to get there, but we need to make sure we are doing this correctly.”

Fast becoming a huge part of ESG initiatives is fleet electrification where particular progress is being made in underground mines. While some countries are certainly more advanced than others here, Provencher noted that 40% of total emissions from the mining industry come from diesel trucks, making EVs a very attractive low-hanging fruit for companies to pursue.

There are, however, a number of challenges associated with bringing in electric vehicles which remains a barrier for introduction. One of the predominant reasons, is the limited range of EVs against diesel counterparts. To mitigate this, Provencher continued, data management is key and ensuring a strong grasp of real-time information coming in will show operators when machinery needs to be charged, allowing them to plan effectively for maximum efficiency on site.

Indeed, this is but a small advantage that digitalisation can bring to the mining industry as it grapples to meet ESG goals while achieving production targets. By getting a better grip of their data and using it to empower tools such as artificial intelligence, advanced analytics and machine learning, companies can achieve tangible benefits such as reduce downtime, enhance worker safety, cut operating costs and, of course, ensure compliance with environmental regulations and targets.

Through the course of the webinar, Provencher outlined this in more detail and explored AVEVA’s suite of cutting-edge software solutions, specifically designed to help mining companies make progress on their digitalisation journey and empower their operations.

Watch the full webinar, completed with detailed case studies and an insightful Q&A session.

-

-

-

Convergent, in association with African Review, has held a detailed webinar exploring the usage and effectiveness of lithium silicates and densifiers over traditional methods of concrete surface management which often struggle to meet the increasing challenges posed by concrete surface management.

Convergent experts including Mputu Schmidt, CEO of Convergent; Carlos Garcia, product manager end-user solutions, construction chemicals, Spain and Portugal for the RD Group; Matteo Mozzarelli, CEO of concrete Solutions Italia; and Jean-Claude Biard, global senior executive for the Convergent Group, presented across the session.

Together, they delved into the latest cost-effective application methods for long lasting finishing of concrete that can help reduce maintenance costs and avoid unexpected repair action. In addition, they examined the advancements in technologies that can sustain increased abrasion resistant stains and ensure gloss retention to the highest quality.

As part of the webinar, the representatives explored case studies including a case in DRC where a medical centre had been constructed with a low-quality concrete floor. The customer was considering completely replacing the floor but instead, Convergent put forward a special treatment with its 244+ Pentra-Sil lithium hardener, densifier and sealer. With this solution, Convergent can increase the hardness of a surface by up to 40% and therefore saved the customer significant recuperation costs over a complete replacement. Convergent were happy to report that the solution was perfect for the facility and the customer was pleased to avoid the extra construction work that would have been required for a complete replacement.

Watch the full webinar, including more information about Convergent’s innovative solutions.

Mondi’s Merebank mill boosts self-sufficiency with new turbine and flood-proofing projects, driving MAP2030 sustainability goals. (Image source: Mondi Merebank)

Mondi, a global packaging and paper leader, has reached a key sustainability milestone at its Merebank mill in Durban, South Africa, through the installation of a new turbine at the site’s power plant

With this development, the mill can now generate 60% of its own electricity, reducing reliance on grid power and enhancing efficiency.

The upgrade features a condensing steam turbine, new cooling towers, piping, and control systems, designed to harness excess steam from the mill’s boiler.

Highlighting the project’s significance, Donovan Naidoo, operations director at Mondi Merebank, said, “By generating power on site, we reduce our dependency on external electricity supply, reduce costs and take a step towards energy independence, climate resilience and long-term operational stability. Once the cooling tower upgrade is completed, the new turbine will produce more electricity than the mill consumes – a significant milestone in our journey towards self-sufficiency.”

Beyond greater energy independence, the turbine also supports a lower carbon footprint for the mill.

In parallel, the mill has finished two flood-resilience projects aimed at reducing risks from natural disasters. These include the installation of flood gates and inflatable flood barriers, enabling the rapid creation of water-catchment dams. These initiatives safeguard operations and surrounding communities during extreme weather, ensuring continuity.

Both the turbine generator and flood-defence projects align with the Mondi Action Plan 2030 (MAP2030) sustainability commitments.

A powerful Kleemann plant train is making its mark at a granite quarry in Tanzania, showcasing strength, efficiency, and reliability

The set-up includes the MOBICAT MC 110 EVO2 jaw crusher, the MOBICONE MCO 90 EVO2 cone crusher, and the MOBISCREEN MSC 953 EVO screening plant, all working seamlessly together after an adventurous journey to reach the site.

A challenging journey to Mwanza

The Kleemann machines began their long trip from Europe to Dar es Salaam, Tanzania. After clearing customs, they were transported by flatbed trucks, rail, and finally along a rugged ten-kilometre dirt road deep into the hinterland. Their final destination was a newly established quarry near Mwanza, close to Lake Victoria, where Sasco Trading is processing granite for infrastructure projects.

“The transport was quite complex and involved. It demonstrated just how important compact mobile plants are,” commented Markus Hofmann, Kleemann Area sales manager Africa. “All the machines were relatively easy to load and transport thanks to their compact design – which proved to be a real advantage on this project.”

Sasco trading’s ambitious entry into quarrying

Sasco Trading, a newcomer to the industry, has set its sights high as Tanzania pushes forward with major road construction projects. The company sees a strong role for itself in supplying essential materials.

The granite being processed is extremely hard, making equipment choice crucial. “We conducted an in-depth search to find out what equipment was available,” explains Sasco Trading owner Sabasi Shirima. With Kleemann already established as a leader in Tanzania and multiple plant trains in operation, the company opted for their proven reliability. “The crushing and screening plants have a very good reputation in Tanzania. This was ultimately the deciding factor for us. Now that we have seen the plants in operation, we know that we made the right decision.”

High output and low fuel use

The plant train processes granite up to 500 mm in size. The MOBICAT MC 110 EVO2 handles the primary crushing, while the MCO 90 EVO2 cone crusher ensures the right grain size and shape. The screening plant then classifies material into three end products: 0–6 mm, 6–10 mm, and 10–18 mm, with other variants available on demand.

With a capacity of 150 tons per hour, the system delivers exceptional performance alongside low fuel consumption: just 12 litres per hour for the MC 110 EVO2, 19 litres for the MCO 90 EVO2, and 16 litres for the screening plant.

Sabasi Shirima emphasises the decision was right: “The crushing and screening plants have a very good reputation in Tanzania. That was ultimately decisive for us. Now that we have the plants in operation, we know: Our decision was correct.”

Intelligent line coupling and automation

The Kleemann plant train benefits from intelligent line coupling and the Continuous Feed System (CFS), which ensure efficient material flow and maximise crusher utilisation. Machines communicate automatically to prevent overloading, and in case of an emergency stop, the entire system halts safely.

“Intelligent interlinking is one of the plant train’s outstanding features. Thanks to automated processes, our customers can look forward to much higher output and much less maintenance,” notes Kleemann expert Jerry Muchiri, who supported the project on site.

User-friendly operation with SPECTIVE

Training new operators was straightforward thanks to Kleemann’s SPECTIVE operating system. Some of Sasco’s team had prior experience with Kleemann equipment, but even newcomers found the system easy to navigate.

“Our employees found their way around very quickly,” says Sabasi Shirima. “The training was thorough but very easy to understand – and the operation afterwards was extremely straightforward.”

Strong on-site support

A ten-day visit from a Kleemann service technician ensured smooth commissioning and detailed operator training. Additional training sessions are available later, either on site or via video conference.

“We know that we won’t be left on our own with any issues in the future. That’s peace of mind,” highlights entrepreneur Sabasi Shirima.

Debmarine Namibia unveils advanced crawler systems on MV Benguela Gem, enhancing offshore diamond recovery operations. (Image source: Debmarine Namibia)

Debmarine Namibia has announced a major advancement in marine diamond recovery with the unveiling of its Next Generation Crawlers, representing a significant leap in offshore recovery technology

This milestone coincides with the delivery of two 800NB crawlers (NB indicates Nominal Bore, the internal diameter of the crawler’s pipeline system) and an upgraded recovery system designed for seamless integration with the MV Benguela Gem.

These advanced crawlers showcase the forefront of marine engineering. Built to operate efficiently in coarser gravels and higher-density panels, they deliver a 20% boost in mining rates and extend pump life by 30%. Each crawler weighs 370 tonnes, redefining operational resilience and capability at sea.

The official unveiling and integration of the new generation crawler onto the MV Benguela Gem took place on 8 September, at Cape Town harbour.

Following the retirement of the MV Grand Banks and MV Coral Sea, the new crawlers are expected to boost Benguela Gem carat recovery by approximately 80,000 high-value carats annually. This increase is projected to more than offset the carats lost due to the retired vessels and aligns with the company’s strategic realignment to address reduced natural diamond demand.

Kevin Smith, chairman of the Debmarine Namibia Board, said, “We are confident that the new crawler investment combined with technological innovation and disciplined cost management, will position Debmarine Namibia to weather the downturn; and will put the company in a better position, poised for recovery when the natural diamond market demand strengthens.”

As the MV Benguela Gem readies for return to Namibian waters at the end of September 2025, Debmarine Namibia acknowledges the exceptional dedication and precision behind this achievement, particularly during financially challenging times. Training initiatives are underway to ensure safe and effective operation of the new systems, reinforcing the company’s commitment to capability development and shared value.

Shakwa Nyambe, board deputy chairperson, said, “This project is a clear example of how strategic foresight and technical excellence come together to deliver long-term value. The new crawlers are not just an upgrade, they are a platform for future innovation.”

“This milestone reflects the ingenuity, collaboration, and pioneering spirit that define Debmarine Namibia,” Smith added. “It demonstrates our unwavering commitment to innovation and excellence in marine diamond recovery.”

The agreement was signed by Dr Abubakar Dantsoho, Managing Director of the Nigerian Ports Authority, and Frederik Klinke, CEO of APM Terminals Nigeria. (Image source: APT Terminals)

APM Terminals’ West African Container Terminal (WACT) in Onne has joined forces with the Nigerian Ports Authority (NPA) to drive decarbonisation efforts across Nigeria’s port and transport sector

The partnership was formalised on Monday, September 22, at the Dutch Consulate in New York during the Global African Business Initiative, where both parties signed a memorandum of understanding (MoU).

The MoU outlines a phased roadmap to electrify containerised freight, aligning with the policies of the Federal Ministry of Marine and Blue Economy.

“We believe that Nigeria is ideally situated to lead West Africa’s transition to low-carbon logistics by electrifying its container transport sector,” said Frederik Klinke, CEO of APM Terminals Nigeria. “Nigeria is Africa’s largest economy and trade hub, and our research shows us that the country can leapfrog fossil-fuel infrastructure and adopt proven electric technologies. We are therefore very optimistic about our joint plans to develop a phased roadmap towards an electrified future for container logistics.”

Responding to the MoU, Dr Abubakar Dantsoho stated, “By this development, the Onne Port will be the first green port in Nigeria and will thereby be promoting the decarbonisation efforts within the transportation ecosystem. This will also make Nigerian ports the leaders on the continent in terms of sustainable port operations.”

The collaboration, fully funded by APM Terminals with an investment of US$60mn, is expected to set a precedent for other African nations.

The agreement builds upon findings from a study APM Terminals presented to Nigeria’s vice-president at the Decarbonising Infrastructure in Nigeria Summit held in Abuja in July. The study highlighted that transitioning from fossil fuels to electrified container freight could attract private investment, generate skilled employment, and improve energy reliability. However, achieving these benefits will require close coordination across industries and robust public-private partnerships.

“For APM Terminals, partnerships are key to generating long-term growth and value in the countries where we operate,” said Jeethu Jose, managing director of WACT. “Our investments are for our shared future and for the people of the region. We look forward to driving this project alongside our stakeholders in the port industry.”

Afreximbank leads US$1.35bn facility in US$4bn syndication to strengthen Dangote’s refinery operations and growth

The African Export-Import Bank (Afreximbank) has announced the signing of a US$1.35bn financing facility for Dangote Industries Limited (DIL)

This forms part of a larger approximately US$4bn syndicated financing arrangement for DIL, Africa’s largest industrial conglomerate, with Afreximbank acting as the Mandated Lead Arranger for the syndication.

This transaction — one of the largest syndicated loans in recent African financial markets — will be used to refinance capital invested in the construction of the Dangote Petroleum Refinery and Petrochemicals Complex, the world’s largest single-train refinery with a capacity of 650,000 barrels per day. The financing will reduce initial operational expenditures, strengthen DIL’s balance sheet, and support its ongoing growth.

Afreximbank’s contribution of US$1.35bn, the largest share among participating banks, highlights its commitment to major infrastructure projects that drive Africa’s industrialisation, energy security, and intra-African trade.

Since the refinery complex commenced operations in February 2024, Afreximbank has continued to provide financial support for crude supply and product offtake, ensuring smooth operations and reinforcing its role in Africa’s most significant refining project.

Commenting on the deal, Benedict Oramah, president & chairman of the board of directors at Afreximbank, said, “With this landmark deal, we once again demonstrate that Africa’s development can only be meaningfully financed from within. It is only when African institutions lead the way that others can follow. The journey to utilise African resources for its own economic transformation is well underway. Through the Bank’s funding support, we are enhancing the capacity of the Dangote Refinery and Petrochemical Industries Ltd to produce and supply high quality refined petroleum products to the Nigerian market, as well as for export to the entire continent and the world. Our energy security is in sight.”

Aliko Dangote, CEO, Dangote Industries Limited, added, “Afreximbank’s contribution to this milestone financing underscores our shared vision to industrialise Africa from within. This refinancing strengthens our balance sheet and accelerates with ease the refinery’s suppy of high-quality refined petroleum products across Africa.”

The syndicated facility attracted strong interest from major African and international financial institutions, reflecting confidence in Africa’s industrial growth and in Dangote’s vision for transforming the continent.

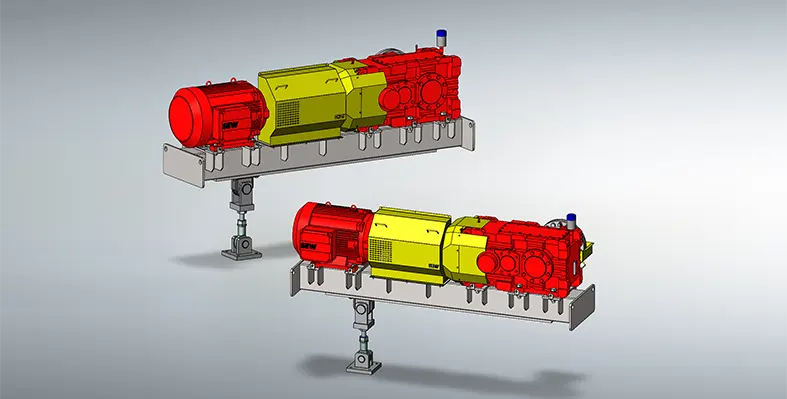

SEW-EURODRIVE’s TrueDNA delivers integrated, high-performance drive solutions with faster lead times and extended warranties. (Image source: SEW EURODRIVE)

The introduction of SEW-EURODRIVE’s TrueDNA package responds directly to challenges faced by industry when mixing components from multiple suppliers in a drive solution

Performance inconsistencies, compatibility issues and support gaps have often compromised efficiency and reliability.

By offering a complete power pack solution from a single original equipment manufacturer (OEM) comprising the highest quality components, SEW-EURODRIVE ensures every component works in perfect harmony - guaranteeing optimum performance, streamlined support for extended warranties and peace of mind.

TrueDNA from SEW-EURODRIVE, a global leader in automation and drive technology, is a fully integrated turnkey drive solution designed for maximum flexibility, performance and efficiency. Engineered to cover a wide range of power, torque and speed characteristics, it can be easily adapted to drive various equipment across multiple heavy industries.

“A major advantage of the TrueDNA package is the significant reduction in lead times,” commented Jonathan McKey, national sales and marketing manager at SEW-EURODRIVE. “Because the majority of components are stocked items, customers can typically expect delivery within six to eight weeks from date of order - a notable improvement compared to traditional sourcing processes. This means quicker access to the latest technological advancements without lengthy delays, enabling customers to start production sooner, generate revenue faster and achieve savings on shorter timelines.

Each TrueDNA solution typically includes a base plate, gearbox, coupling and motor - all precisely matched to ensure seamless compatibility and optimum operational performance. Most customers opting for TrueDNA have selected the innovative X.e series gearbox, renowned for its enhanced efficiency, durability and energy-saving features.

The drive train is pre-filled with the customer’s lubrication of choice, although SEW-EURODRIVE recommends its latest advanced oil technology which offers extended lifetime, superior lubrication

properties and improved efficiency in power transfer. With proper maintenance, customers can further reduce costs through extended oil change intervals.

“Choosing the TrueDNA package not only means acquiring cutting-edge drive technology, but also gaining additional value through extended warranties and complimentary maintenance training for end-user personnel,” McKey noted. “We are committed to ensuring optimum long term performance

and supporting our customers’ operational excellence.

With TrueDNA, SEW-EURODRIVE redefines industrial drive solutions - simplifying procurement, optimising performance and delivering a future-ready package built to meet the toughest demands of modern industry.