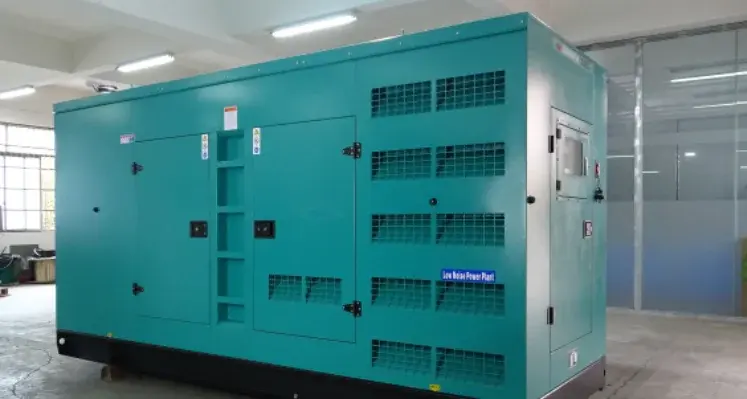

Dingbo Power has confirmed a new order from Haiti for a 600kW heavy-duty silent diesel generator set, now in production. (Image source: Dingbo Power)

Dingbo Power has recently secured an order from a Haitian client for a 600kW heavy-duty silent diesel generator set. Production began on 25 October, with a delivery period of 20 days

Manufacturing is progressing as scheduled, and the generator will be completed and shipped in full alignment with the client’s requirements.

The generator set, manufactured by Guangxi Dingbo Generator Set Manufacturing Co., Ltd., is the DB-600GF model, designed as a silent-type unit. It delivers a prime output of 600kW/750kVA and a standby output of 660kW/825kVA, operating at 440V with a rated current of 984A. Running at 1800 rpm and 60Hz, it features a 0.8 lag power factor and a three-phase, four-wire configuration. The system is powered by a Cummins KT38-G diesel engine and paired with a Shanghai Stamford GR355G1 alternator. Control and monitoring are managed through the SmartGen HGM6110N-4G-G controller, which includes integrated 4G cloud remote monitoring capabilities.

The client emphasised the need for a heavy-duty silent generator, a requirement Dingbo Power is addressing with a reinforced 6mm-thick steel base frame to increase durability and stability. The generator will be housed inside a specially designed silent canopy made from 2mm-thick galvanised steel sheets. This enclosure provides strong corrosion resistance and keeps operational noise at just 80 dB(A) at a 7-metre distance, making it suitable for noise-sensitive environments.

At the heart of the system is the Cummins KT38-G diesel engine, known for its reliability and efficiency under demanding conditions. It is a 12-cylinder, V-type, 4-stroke water-cooled engine with turbocharging and a 38-litre displacement. It delivers 679kW of prime power and 747kW of standby power at 60Hz and 1800 rpm. The engine features an electronic governor, a 15.5:1 compression ratio, and a 159mm × 159mm bore and stroke. Fuel consumption ranges from 43 kg/h at 25% load to 131 kg/h at 100% prime load, and 147 kg/h at 100% standby load. Additional technical specifications include a 24V electric start system, Cummins PT fuel injection, a coolant capacity of 112L, and an oil system capacity of up to 135.1L.

Dingbo Power expressed gratitude to the Haitian client for their trust and highlighted that this customised heavy-duty silent generator reflects the company’s commitment to delivering high-quality, durable power solutions. The production team is fully dedicated to the project and confident that the final unit will provide reliable performance and long-term operational value.