As a challenging year for sub-Saharan Africa draws to a close, positive signs suggest an economic rebound is on the cards in 2024, according to economist Moin Siddiqi

2023 was a difficult year for activity in sub-Saharan African (SSA) countries reflecting a sluggish global economy (hence lower export demand); weaker domestic currencies and high borrowing costs; the Sahel security crisis, ongoing geopolitical tensions alongside a cost-of-living crisis; and heightened debt vulnerabilities.

Growth in SSA is estimated to remain modest, at between 2.5% (World Bank); 2.6% (Economist Intelligence Unit); and 3.3% (International Monetary Fund), down from 4% in 2022. The continued weakness in larger economies (South Africa and Nigeria) is dragging down region’s economic performance. In per capita terms, growth in SSA has not risen since 2015.

Consumer price inflation (CPI) has peaked in most countries due to the easing of global supply chain disruptions, lower commodity prices, and contractionary monetary policy to abate inflationary pressures. After reaching a 14-year high of 9.3% in 2022, inflation is expected to slow to 7.3% in 2023 (World Bank data) – well exceeding central banks’ CPI target.

Public finances are stabilising, but fiscal deficits in 2023 were still above pre-pandemic levels for two-thirds of countries. Half of least developed countries (LDCs) in SSA are at high risk or in debt distress. The average public debt-to-GDP ratio in the region rose from 35% in 2005 to 63% by 2022 (IMF data). Whilst debt service obligations have soared due to a shift towards market financing in some countries (notably Kenya, Ghana, Angola, Côte d'Ivoire and Nigeria), which is more expensive than soft loans from official creditors.

Green shoots of recovery

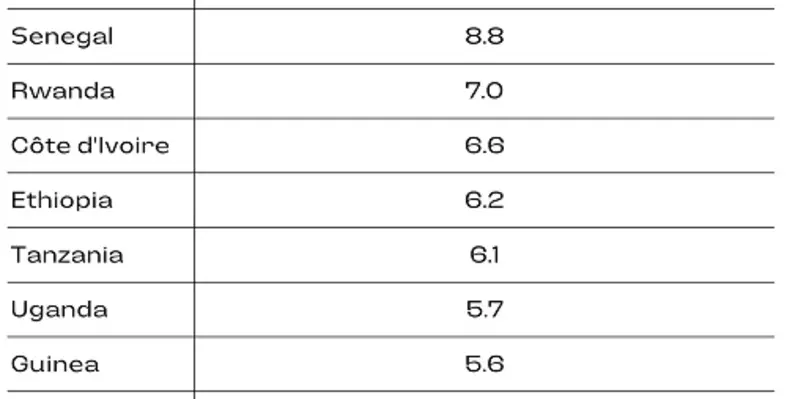

Regional slowdown appears to have bottomed out in 2023 as economic activity is expected to rebound to between 3.2% to 4% in 2024. Growth should revive in four-fifths of SSA economies – only Equatorial Guinea and Sudan in protracted recession. SSA’s growth, excluding major economies such as Nigeria and South Africa, is projected at 5%, up from 4.3% in 2023 (IMF data).

Both the IMF and EIU expect SSA to rank as the world’s second fastest growing economy in 2024 after Asia (propelled by China and India).

The service sector will be the main driver of regional expansion – accounting for 60% of growth surge in 2024–25 (World Bank data). The agriculture and industrial sectors as well as exports will make positive contributions. A recovery in world trade, plus easing of global financial conditions are also supportive factors. “Resource-intensive economies and major exporters will continue to do well given the intensive competition and high prices for Africa’s supplies of hydrocarbons, mining sector output and agricultural produce,” EIU noted.

The EIU is particularly bullish on East Africa, which should once again prove itself as the most dynamic sub-region. It commented, “The service sector will play a major role in driving the economies of East Africa, including resurgent travel, tourism, and hospitality; resilient transport and logistics; and vibrant financial and telecommunication industries.”

There is significant divergence between ‘resource-intensive’ and ‘non-resource-intensive’ economies. Real GDP growth in the former group is predicted at 3.2% in 2024, buoyed mainly by private consumption and in some cases, a few new (or repaired) hydrocarbon projects coming onstream (Niger, Senegal), and mining projects starting production (Congo DRC, Liberia). Robust growth (4.8% - 5.9%) is expected for the latter group thanks to expansion in services, a recovery in consumption and investment, as well as lower import bills.

The African continent as part of the global economy is, however, exposed to downside and upside risk scenarios. A deeper-than-expected contraction in China’s real-estate market and weaker consumer confidence in advanced economies would undermine global activity and tighten financial conditions for emerging markets and developing economies (EMDEs) borrowers, leading to a -1.25% cumulative drop in SSA output over 2024–26.

On the other hand, faster disinflation (i.e., falling prices), higher commodity prices, and a robust recovery in investment in advanced economies could lift cumulative output in resource-intensive SSA by almost 0.5% of GDP over 2024–26, according to the IMF.

Moin Siddiqi, economist.