Private equity represents a source of working capital, complementing more traditional bank debt and project finance, with PE investors offering more than just funds

Private equity investors offer more than just funds. By injecting risk-capital, they become partners in a firm’s growth. It helps unlisted dynamic companies to expand, create jobs and ultimately facilitate growth in their economies. Therefore PE is a perfect fit for developing Africa.

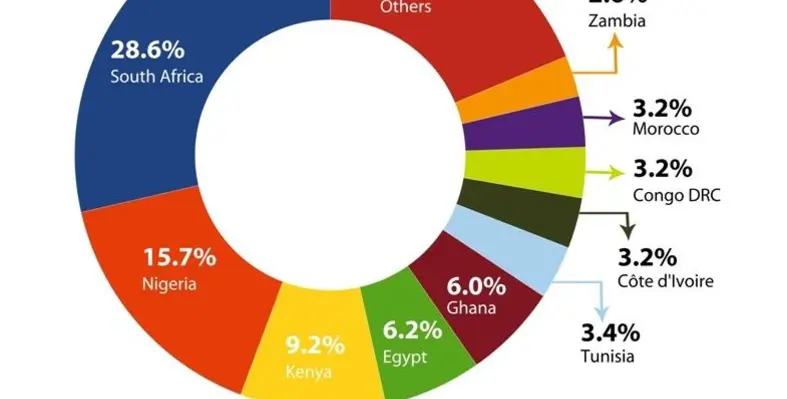

Private equity business can be divided into distinct regions. South Africa (most developed market). North Africa is centred around Egypt, Morocco, and Tunisia. The west African market pivots around Nigeria and Ghana, while east African market is led by Kenya, but also includes Ethiopia and Tanzania. A francophone market is steadily developing in Cameroon, Côte d'Ivoire and Senegal. Regional or country-specific PE funds have emerged as a growing asset class driven by economic liberalisation, demographic dynamics and urbanisation coupled with increasing technology-driven productivity, especially in the information and communication technologies (ICT) and banking sectors.

In 2016, a survey of Limited Partners by Emerging Market Private Equity Association (EMPEA) ranked sub-Saharan Africa (SSA) as the fourth most attractive emerging market behind India, Southeast Asia, and South America (excluding Brazil). The African Private Equity and Venture Capital Association (AVCA) reported that PE funds invested US$21.6bn in 833 deals over 2010-15 – targeting mostly fast moving consumer goods (FMCG), banking/finance, industrial and telecoms sectors. The total value of African-PE fundraising between 2010 and first-half 2017 was US$20.5bn. West and South Africa received largest share of PE deals. East Africa is also gaining ground; it attracted third of the total deals during January-end June 2017.

Both fundraising and investment totals for sub-Saharan Africa (SSA) fell, year-on-year, in 2017, decreasing 25 and 40 percent, respectively, according to EMPEA – impacted by regional economic slowdown. Kenya replaced Nigeria and South Africa as No.1 destination for investment, receiving 21 deals. The most active sectors by volume were consumer staples and financials, while telecoms and materials ranked largest sectors by value during first-half 2017.

Top 10 African countries by deal volume (per cent) 2012-2016.

Private equity majors

The arrival of global funds shows investor’s appetite for pan-African companies (including start-ups), seeking both scale and diversification of country-risk. Private equity funds under management have exceeded US$30bn according to US’ Boston Consulting Group (BCG). Among some prominent groups are:

*London-based Helios Investment Partners (founded in 2004), which operates a diversified portfolio in 25 countries worth US$3bn. It also manages the US$110mn Modern Africa Fund on behalf of foreign entities, including US Government’s Overseas Private Investment Corporation and few leading US firms. This year, Helios supported by GE Ventures has led the largest venture capital raising (US55mn) to provide off-grid power in West Africa.

*U.S. Caryle Sub-Sahran African Fund Ltd (established in 2012) raised US$698mn for strategic minority investments, of which two-thirds were invested across nine deals. Operating from offices in Johannesburg and Lagos, Caryle targets FMCG, financials, ITC, agribusinesses and energy deals in South Africa, Nigeria, Kenya, Tanzania, Ghana, Mozambique, Botswana, Zambia and Uganda. It recently invested US$100mn in CMC Networks, a pan-African network connectivity provider and completed leveraged buyout (LBO) of Royal Dutch Shell onshore assets in Gabon.

*Helios Towers Africa – supported by George Soros Fund Management – is a private-held firm operating in the wireless communications industry. In January 2015, it raised the largest ever equity fund (US$1bn) to buy regional telecoms providers. UK-based co. is engaged in buying telecommunication towers held by single operators and leasing them back to the seller and multiple other operators simultaneously. Main focus: Ghana, Congo (DRC), Tanzania and Nigeria.

*Black Rhino (owned by US Blackstone Group) focuses on the development and acquisitions of infrastructure projects across Africa. It has invested over US$2bn mostly in Nigeria, Ethiopia, Mozambique and Togo. Dangote Industries and Black Rhino have agreed to jointly invest US$5bn over the medium-term across SSA with a particular emphasis on power, transmission and pipeline projects.

*Emerging Capital Partners (ECP) is a Pan-African PE-firm with a portfolio of 60-plus investments (worth US$2.7bn) across 40 countries and has realised nearly 40 full exits. It specialises in seed, start-up, venture, growth capital, development, bridge financings, buyout and recapitalisation in mid-cap markets. The firm also makes mezzanine investments (subordinated debt).

*Actis Capital (UK), founded in 2004, has invested over US$5.5bn in 70 African companies, of which 50 have been exited. Its third Africa Real Estate Fund-3 (2015) still remains

sub-saharan Africa's biggest fundraising that targets prime retail, office and industrial developments in eight countries (excluding South Africa).

*The Dubai-based Abraaj Group with reported investment of US$3.2bn in over 80 mid-cap companies over the last two decades.

*Development Partners International (DPI), a London-based manager has invested about US$1.1bn in PE-backed transactions in Africa.

*CDC Group Plc (UK) is the largest single investor in PE firms, supporting 58 funds investing in 32 out of 54 countries on the continent.

Best strategies

Private equity flows raises business standards and creates a pool for talent as more investment banks and institutional investors establish a local presence. Investors usually have a long-term perspective aimed at ‘value-creation’ by driving operational advances, providing technical know-how and networks. Such investments also promote environmental, social, and governance (ESG) standards as investors seek reliable internal auditing and bookkeeping.

Fund managers include Africa as part of a risk-diversification strategy. To succeed, PE managers require local insight and strong-sector knowledge.

“The key to success in the African market is execution. Investing at the right price is important, but what also matters is having the right management team on the ground. Discipline and following a strategy is vital. Getting the exit right, including the timing, is also essential,” said Runa Alam, chief executive DPI.

To generate higher returns, funds should pursue more flexible investment strategies and new types of corporate targets, advised BCG in its 2016 report: ‘Why Africa Remains Ripe for Private Equity’. Most funds adopt similar type of deal structure – investing only in minority stakes with a view to better managing their risks by leveraging strong local partners. Further, they overwhelmingly target businesses with annual turnover of US$100mn-plus and proven track records. BCG recommends private equity investors to consider other approaches such as majority stakes and strategic partnerships as well as investing in new vibrant smaller companies – which remain off the radar of most funds.

Building local capabilities that add value to companies can over time generate healthy profits. According to AVCA, most PE managers reported returns of 2.5 to three times on their investments in Africa. This is comparable to returns prevailing in Asian markets but exceeds the average 1.9 in Europe and U.S. However, with increasing volumes chasing limited opportunities, entry values for larger attractive assets (mostly financials and energy) have increased in recent years. “As prices for stakes in large African companies rise, it will become more difficult for private equity funds to deliver high returns,” noted BCG.

Business strategies of African-focused private equity funds are distinct from other parts of the world. Most hold investments for longer than in developed markets and using less debt, whilst some invest in small-medium sized enterprises (SMEs) to nurture them to a size viable for large trade buyers.

Operational challenges

Overall, there are significant obstacles to private investments in Africa: political, currency, commodity prices, capital access and execution risks. According to AVCA, 60 per cent of Limited Partners cite currency risk as the biggest challenge when investing in African private equity. “The last few years have been tough for PE returns. Currency devaluations hit returns hard; once you have experienced it, it is hard to recover and you need time, but most of the time returns will recover,” said Miguel Azevedo, head of Africa investment banking at Citi. Andrew Brown, chief investment officer ECP, agreed: “Evaluating and managing currency risk is a key competence for any emerging market PE manager.”

Complex and fragmented regulation constitutes a barrier for businesses looking for an exit by way of an initial public offering (IPO). Excepting South Africa, Nigeria and Kenya, underdeveloped and illiquid capital markets characterize SSA. However, a nascent (but growing) secondary PE market (i.e. the sale from one PE firm to another) has facilitated some trade sales in recent years. Also, access to updated financial/corporate information is limited.

Given the shortage of investment banks that typically screen opportunities and present them to investors, funds need to originate their own deals with proper due diligence. “Africa’s underdeveloped investment environment means that PE firms need to build significant on-the-ground capabilities that they normally do not require in more developed markets,” said Seddik El-Fihri, BCG expert principal. There are few ‘ready-made’ pan-African companies, hence the challenge is to identify strong unlisted businesses with potentials for both domestic and cross-border expansion.

In sum, private equity could become a major force for accelerating growth in African countries. Thus far, regional penetration is low, but smaller markets and modest penetration create significant potential for high risk-adjusted returns. Major growth sectors are natural resources, transportation, energy, real estate, fintech, healthcare and hospitality. Many private equity funds are nurturing the requisite skills and experience to invest, grow and add value to portfolio/innovative companies.

By Moin Siddiqi, economist