Private equity funding success relies on a dynamic and entrepreneurial approach and the African market is ripe for generating higher returns for investors. African Reviews economic correspondent Moin Siddiqi reports

Private equity (PE) is capital invested directly by funds and investors in private companies. Pools of funds are often created by PE firms or venture capitalists (angel investors), each with their own goals, preferences and investment strategies. These include leveraged buyouts, growth capital, distressed investments and mezzanine capital. These strategies provide working capital to a target firm in order to nurture its expansion, assist new product development, or restructure operations and management.

PE is a business based on expansion and entrepreneurial spirit towards exploring new ways of growth. Africa is a lucrative market to generate higher returns, reflecting favourable demographics such as rising urbanised middle class populations (projected to grow to 500mn by 2030). Consumer spending is expected to grow by 3.8 per cent a year to total US$2.1tn by 2025, coupled with mineral wealth and growing labour forces. According to the Emerging Markets Private Equity Association (EMPEA), sub-Saharan Africa (SSA) was ranked third most-attractive destination for PE investment during 2014-15 (up from seventh in 2011) when compared with peer developing regions.

The African Private Equity and Venture Capital Association (AVCA) estimated that during the period 2010-15, PE funds invested US$21.6bn in 823 deals, 63 of which were reported in 2015, worth US$2.5bn (see overleaf). In fact, weaker local currencies and the global commodity slump could attract more PE-backed acquisition deals in Africa over the coming months.

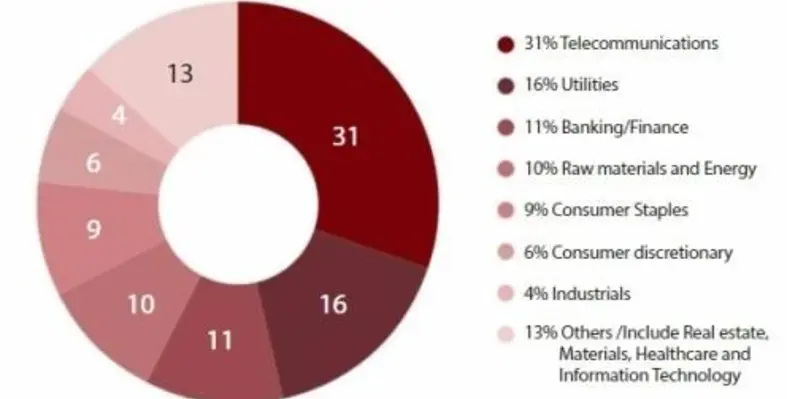

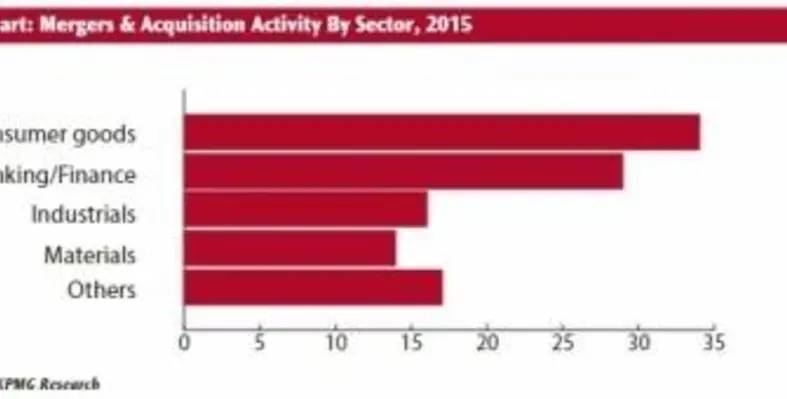

Attractive sectors for PE businesses are consumer products and retail (CPR), and technology, media and telecoms (TMT). Other areas include brewing, banking, insurance, professional services, technology, real estate (including hotels), utilities, logistics, pharmaceuticals, private healthcare, education and manufacturers of processed foods, soaps and detergent (see above chart). Consumer and financial services represented two-thirds of total deal volume in 2015 (see overleaf), according to KPMG research. South Africa, Nigeria, Kenya, Ghana, Zambia and Mauritius received the most investments. According to AVCA, 311 PE deals (worth US$6.1bn) went to West Africa – dominated by Nigeria and Ghana. Both countries combined accounted for 65 and 93 per cent of the deals by volume and value, respectively, between 2007 and mid-2015.

Profusion of funds

Established UK-based PE managers operating in Africa include Actis Capital, which has invested more than US$3bn spread across 23 countries, one fifth of which is being invested in financials.

In 2015, Actis and a diverse collective of backers – pension funds, sovereign wealth funds, development finance institutions and endowments – raised US$500mn for its third Africa Real Estate Fund 3 (ARE3), the largest opportunistic private real estate fund targeting sub-Saharan Africa, excluding South Africa, to date. ARE3 invests predominantly in prime retail, office and industrial developments in the capital cities of seven to eight countries. Neil Brown, partner, says, “Africa is under retailed, hence we expect that around 40 per cent of the capital will be invested in retail shopping centres.”

With US$1.1bn under management, Development Partners International (DPI) has injected US$100mn through its ADP II Fund in Atlantic Business International (ABI), a subsidiary of Morocco’s Banque Centrale Populaire. ABI is the third-largest banking group in the West African Economic and Monetary Union (UEMOA) and second largest bank in Côte d’Ivoire in terms of deposits, according to AVCA. DPI, which in March 2015 raised US$725mn, states, “We want to also capitalise on strong growth prospects and low banking and insurance penetration in the UEMOA region.” Other portfolios include Université Privée de Marrakech, a leading private university; RTT, Africa’s largest private-owned parcel distribution company; HomeChoice, a home-shopping and credit retailer; and Eaton Towers, a telecom tower company.

With US$1.1bn under management, Development Partners International (DPI) has injected US$100mn through its ADP II Fund in Atlantic Business International (ABI), a subsidiary of Morocco’s Banque Centrale Populaire. ABI is the third-largest banking group in the West African Economic and Monetary Union (UEMOA) and second largest bank in Côte d’Ivoire in terms of deposits, according to AVCA. DPI, which in March 2015 raised US$725mn, states, “We want to also capitalise on strong growth prospects and low banking and insurance penetration in the UEMOA region.” Other portfolios include Université Privée de Marrakech, a leading private university; RTT, Africa’s largest private-owned parcel distribution company; HomeChoice, a home-shopping and credit retailer; and Eaton Towers, a telecom tower company.

Helios Investment Partners boasts a diversified portfolio in over 25 countries, with funds totalling US$3bn. Helios is using proceeds from its third Africa-focused fund (US$1.1bn) raised in January 2015 to acquire assets in CPR, TMT, energy, transport and logistics and banking sectors. Among its recent acquisitions are Telkom Kenya (60 per cent equity) and 49 per cent voting rights in Nigerian integrated energy solutions provider Oando.

US funds have also entered Africa’s niche market, led by The Carlyle Group (its SSA Fund closed in 2014 at US$698mn). TPG Capital, which plans to invest US$1bn in partnership with Africa-based PE fund Satya Capital owned by Sudanese billionaire and philanthropist Mo Ibrahim and Emerging Capital Partners, manage more than US$2bn in African businesses. Other names include Kohlberg Kravis Roberts (KKR), Sun Capital, Protea Asset Management, and Blackstone Group, which focuses on greenfield infrastructure projects through its portfolio company Black Rhino – headed by former Central Bank of Nigeria governor Lamido Sanusi.

In the US, the New York State Common Retirement Fund has invested US$200mn in African companies through Helios Investment Partners and African Capital Alliance. The fund announced it would invest three per cent of its assets (estimated at US$180bn) into sub-Saharan Africa over the next five years. American university endowments – reportedly holding US$400bn in combined assets – is also showing a keen interest in investment. The University of Texas Investment Management Company invested US$150mn through Helios and Actis during 2015.

Other prominent managers in sub-Saharan Africa include Dubai-based The Abraaj Group, which reported an investment of US$3bn into 67 mid-cap firms and 30 full or partial exits in the past decade; Aster Capital Partners (France), which targets renewable energy projects; Old Mutual PE (South Africa); Meijer Realty Partners (Holland); and Brazilian BTG Pactual. Leading pan-African investment firm African Capital Alliance has raised over US$1bn since its formation in 1997. Its fourth PE fund (closed at US$570mn), Capital Alliance Private Equity IV (CAPE IV), builds on previous funds by buying into fast-moving consumer goods (FMCG), TMT, energy and business and financial services.

Recent investments & exiting

The African PE Data Tracker report from AVCA shows the total value of deals – comprising 83 transactions – in H1 2016, reached US$900mn. “Our figures illustrate a resilient PE industry despite continued economic volatility and similar fundraising levels when compared to 2014 (US$2bn),” the report states. However, EMPEA figures indicate that following a record 2014-15 for fundraising, funds targeting sub-Saharan Africa slowed down, raising US$725mn between January to June 2016 and deploying US$584mn in the region. Financials led all other sectors in deals completed with a total of 10, while the power sector also retained investor interest. Globally, fund managers raised US$15.1bn, while investing US$13.3bn in emerging markets, which represented a decline of one-third and one-fifth, respectively, year-on-year.

A survey by accountancy firm Deloitte (2015) indicated that 67 and 42 per cent of respondents expected PE exit environment to improve in East and West Africa, respectively, over the next year. There were 58 PE exits in 2015 across SSA, the highest on record since 2007, according to KPMG research. But exiting is difficult compared to other emerging markets. Law firm, Addleshaw Goddard explains, “Investment managers [in Africa] must remain nimble and take a long-term approach to exit opportunities to achieve expected returns.”

The African-focused funds face numerous challenges – lack of liquidity in capital markets (except South Africa), complex or fragmented regulation, onerous capital controls, currency risk (i.e. devaluation), the scarcity of investable midcap firms, as well as infrastructure bottlenecks.

“Firms are too small, lack human capital and are often within underdeveloped sectors,” echoes the Overseas Development Institute (UK). Global wealth manager UBS advises potential investors to ask questions before acquiring a frontier-based company: Can they gain a controlling stake? What is the regulatory framework? Can they eventually exit the company and should they hedge forex risk? In sum, significant efforts and resources have gone into developing a fully-fledged PE industry in Africa. Over time this will improve basic infrastructure, create jobs (particularly youth employment) and boost managerial-technical expertise of small and medium-sized businesses, thereby driving their growth and transforming them into successful, independently managed, best-in-class players in their respective sectors.

Footnote:

Venture investment refers to start-up (seed) capital made typically in less mature companies or in early stage development, or expansion of a business. Such investment is mostly found in the application of new technology and product innovation that lacks a proven track record or stable revenue streams.

Leveraged buyout (LBO) refers to a strategy of making equity investments as part of a transaction where a company, or business asset(s) is acquired from existing shareholders typically with the use of significant amounts of borrowed money. A PE firm takes majority ownership in an existing or mature firm

Growth capital refers to equity injections, mostly minority stakes, in relatively mature companies for expansion, restructuring, entering new markets, or funding a major acquisition without a change in control of ownership

Mezzanine capital refers to subordinated debt or preferred equity securities – largely comprising a junior portion of a firm's capital structure that is senior to the company's common equity.

Moin Siddiqi, economist

This piece first appeared in African Review is December/January 2017.