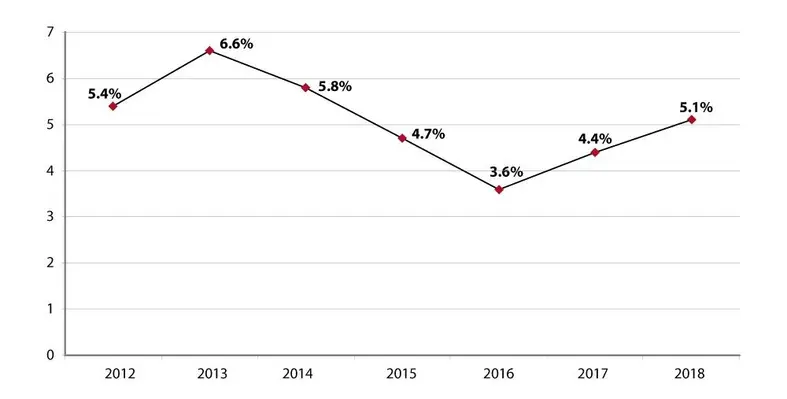

After broad-based slowdown in 2016, growth revival is underway across much of sub-Saharan Africa

Twenty of the region’s 45 economies are expected to grow robustly at five per cent or higher (mostly in eastern and western Africa) in the New Year.

The International Monetary Fund (IMF) regional growth outlook is at 2.6 and 3.4 per cent, respectively for 2017 and 2018 is similar to World Bank’s projections. Growth in SSA excluding Nigeria and South Africa is higher, on average at 5.1 per cent in 2018-19, close to the levels seen since early 2000s.

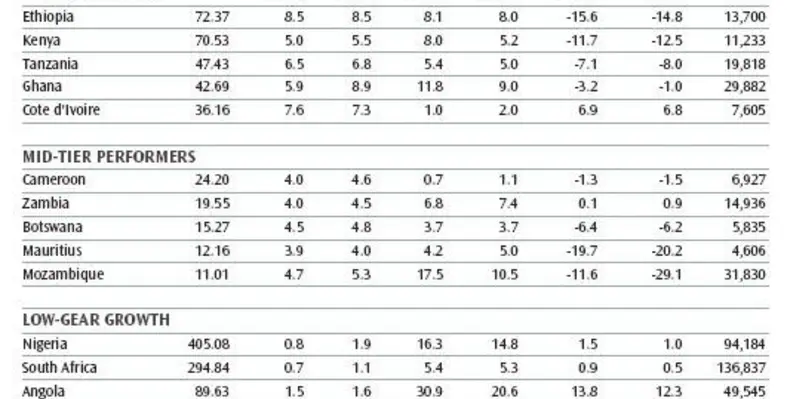

Developing Africa is a highly diverse regional economy; aggregate growth numbers for the New Year should fall into three divergent groups (see table 1):

*High-achievers – where growth is driven by continuous infrastructure investment (Ethiopia), business-friendly reforms (Senegal and Rwanda), higher oil-gas production (Ghana), along with recovery in the agricultural sector and domestic demand. Elsewhere, growth is expected to recover in Kenya, as political uncertainty eases after the presidential elections and improve in Tanzania on upturns in public investment. Activity is also rebounding in countries hit by the 2015 Ebola outbreak (Guinea, Liberia and Sierra Leone). Ethiopia should remain Africa’s fastest-growing economy over the coming years.

*Mid-tier performers – where increased output and investment in the mining sector is supporting growth in metal exporters (Niger and Zambia), along with strengthening activity in services (Mauritius) and non-oil sector (Cameroon). Improved weather conditions in southern Africa will boost agricultural output (Mozambique and Zambia). The latter has benefited from recent rainfalls since hydropower sources account for 97 per cent of total electricity production in Zambia, according to the World Bank. But default on foreign debt by the Mozambique government has increased risk-premium, however, ENI (Italian oil major) in June 2017 approved final investment decision for the Coral floating (FLNG) facility in Mozambique, with nameplate capacity of 4.5bn cubic metres/year. The project will have a multiplier-effect on the broader economy.

*Slow-growth lane – SSA's largest economies: Nigeria, South Africa, and Angola have exited recession, however, their pace of recovery remains tepid. Increased oil production thanks to stability in the Niger Delta (the country’s oil-belt) and good harvest led to growth revival in Nigeria. Reforms in the forex markets will help the non-oil sector, which until 2014 was expanding at a brisk pace. An upturn in the petroleum sector too helped SSA’s

second-largest oil producer (Angola), although fiscal consolidation measures have slowed non-oil growth.

The normalisation of mining and agricultural production lifted GDP growth in South Africa, but policy uncertainty and low business confidence continue to hinder private investment. Faltering domestic demand also weighs on the manufacturing sector and high unemployment affects consumer businesses.

Activity has weakened in most Central African Economic and Monetary Community (CEMAC) countries (Chad, Congo, Republic and Gabon) due to steep cuts in public spending. While deep recession has gripped Equatorial Guinea since 2014 caused by depressed oil revenues and rising debt levels.

Low financial buffers

Region-wide, currencies have stabilised after hefty depreciations in 2016, while ‘single-digit’ inflation is predicted in most countries (except Angola, Congo, DRC, and South Sudan) amid currency stability and higher food production. Fiscal deficits slightly narrowed, but continued to be high in Angola, Equatorial Guinea, Kenya, Mozambique and Zambia, as fiscal adjustment measures remained partial at best, noted the World Bank. But macroeconomic imbalances have emerged in many countries – reflected in rising public debt, which is now above 50 per cent of GDP in half of regional economies (Table2). Government debt has swelled in Congo, Republic, Eritrea and Gambia – exceeding 100 per cent of GDP (IMF data).

Concurrently, debt service costs have risen, especially among oil-exporters. In Angola, Gabon, and Nigeria they absorb nearly two-thirds of government revenues. Hence, diverting scarce resources away from priority areas like healthcare and education. Banks’ liquidity and solvency indicators have deteriorated, and non-performing loans have increased (Angola, Ghana, Nigeria). Some countries have seen a sharp fall in credit to the private sector.

While current account deficits have narrowed, forex reserves remain low in many countries – below the global benchmark of three-month import cover. The World Bank said: “The prospects of stabilising commodity prices, together with financial inflows, should enable commodity exporters to accumulate international reserves, but the low import coverage will weigh on the ability of central banks to continue managing their currencies.” On positive side, a pickup in commodity prices has induced foreign investments in extractive industries.

Current low yields on global capital markets have increased investor appetite for SSA’s debt instruments, reflected in rising sovereign bond issuances from an average of US$3.5bn in 2010-13 to US$6.2bn over 2014-17 on favourable terms 6.5 per cent (World Bank data). South Africa, Côte d’Ivoire, Ghana, Nigeria, Angola, Zambia, Kenya and Senegal account for the bulk of total debt issued.

New policy approach

With real GDP growth at its lowest in three years, a focus on major reforms is needed to help turn around the slowdown into higher growth over the medium-term. *Most notably, tackling infrastructure bottlenecks such as roads, ports and energy to connect people to markets. The African Development Bank estimated that weak physical infrastructure in countries could reduce GDP growth by two percentage points/year. Africa needs about US$100bn/year on infrastructure investment (World Bank data), but present capital spending across the region is US$50bn. Pubic-private partnerships are central to SSA’s infrastructure building.

*Boosting agricultural productivity and output through investment in improved technologies, rural financial services, and better access to markets. Africa is endowed with 60 per cent of the globe’s uncultivated arable land. Improved processing and storage facilities can help ensure regional food security.

*Demographic trend: by 2030, half of the annual hike in global working age population will come from SSA. But jobless rate is high; investment in higher education/skills remains vital preparing future generations to compete in the global market. More emphasis is needed on science/technology. In the next decade, 11mn youth/year will enter the job market (World Bank estimate).

*The reform of public institutions and the judiciary - inefficient and opaque state bureaucracies have stymied the public sector and foreign direct investment (FDI). Strengthening governance, including the rule of law/fighting corruption and tackling obstacles such as inadequate electricity and financial services will support business growth and aspire new entrepreneurs.

*Africa should strengthen its tax collection: it stands among lowest in developing regions, which constrains growth-enhancing investments. It could invest more in public services by raising non-commodity revenues, closing tax avoidance loopholes, and better prioritisation of public spending.

*Deeper regional integration remains critical to improve connectivity, leverage economies of scale, and attract higher FDI, especially in non-extractive sectors.

In sum, significant challenges lie ahead to promote shared prosperity since output growth remains below the pre-crisis average. “Sub-Saharan Africa can seize opportunities to enhance growth above current projections through structural transformation and export diversification. Macroeconomic stability carries a large premium, but beyond that, many countries could also strengthen their growth prospects by improving access to credit, infrastructure and the regulatory environment and building a skilled workfoce,” IMF urged.