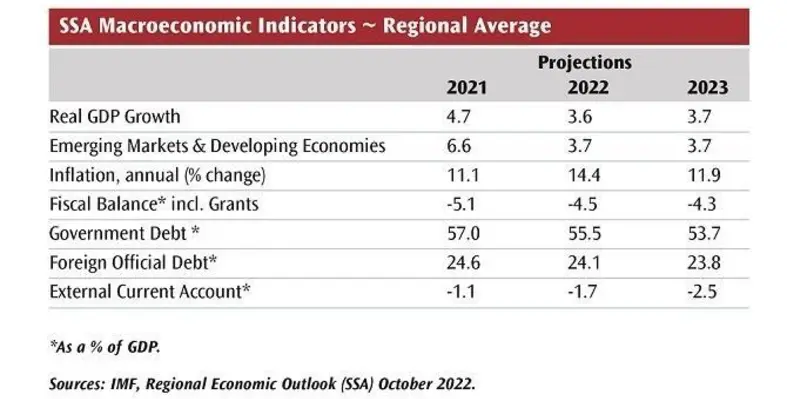

Sub-Saharan Africa (SSA) is expected to experience a 3.6% economic growth in 2022, down from 4.7% in 2021, due to tepid investment and worsening of trade balance

High energy and food prices, causing a cost-of-living crisis, tighter financial conditions and persisted supply constraints decelerated growth, leading to stagnating income-per-capita in majority of countries.

The overall economic activity, however, masks some regional heterogeneity. Diversified ‘non-resource-intensive’ countries (led by Senegal, Rwanda, and Cote d’Ivoire) are among the more dynamic/resilient economies, growing by 4.6% in 2022, compared to 3.3% and 3.1%, respectively, in oil exporters and other resource-intensive countries (according to IMF data). SSA growth, excluding heavyweights Nigeria and South Africa, is projected to slow to 4.3% in 2022, from 5.1% in 2021, but exceed regional performance.

Following global trends, inflation dynamics in SSA are driven by spiralling costs for imported food and fuel, which comprise about half of region’s consumption basket. The depreciation of domestic currencies and disruptions to global supply chains have also added to rampant inflation over the past year. Double-digit inflation was reported in around one-third of SSA economies.

External payments outlook has deteriorated in many countries. Given rising import bills, the regional current account deficits have widened, exerting increased pressure on domestic currencies, thus feeding back into higher inflation. That, in turn, led to contractionary monetary policy, which weighs on economic activity. Capital outflows led to large depreciations especially in Ghana, Malawi, and Sierra Leone.

SSA’s terms of trade (i.e., the ratio between a country’s export prices and its import prices) are still expected to improve in 2022, compared with last year, but significant heterogeneity persists. Oil-exporters can expect an improvement of 16%, while non-resource-intensive countries face a drop of about 4.2% (IMF data).

Macroeconomic imbalances are approaching levels not seen in decades, especially for countries with limited buffers. Strains on public finances are due to falling revenues in the wake of Covid-19 crisis. The fiscal deficit for SSA is projected to narrow slightly from 5.1% of GDP in 2021 to 4.5% in 2022, but still above recent trends.

On public debt, regional indebtedness has now reached levels on par with early 2000s before the impact of the Heavily Indebted Poor Countries Initiative. Over two-thirds of SSA countries with elevated debt are non resource-rich countries. Five countries – Eritrea (234.9), Sudan (183.8), Cabo Verde (147.7), Ghana (104), and Mozambique (102.6) – will register debt to-GDP ratios in 2022 above 100% (World Bank data).

Into the new year

Regional prospects vary significantly across countries. Growth projections from IMF and World Bank are 3.7% and 3.5%, respectively, supported by a timid recovery in gross fixed investment and private consumption, reflecting the end of the tightening cycle of monetary policy as inflationary pressures subside. On the production side, both agriculture and industry should also underpin steady growth and employment. In fact, 18 of SSA’s 45 countries are poised to grow by over 5%, led by Senegal, Niger, Rwanda, Congo DRC, and Cote d’Ivoire (IMF estimate). A drop in commodity prices and effects of contractionary macroeconomic policies will abate inflationary pressures.

Non resource-rich countries are forecast to grow 4.7% and 5.3% in 2023 and 2024, respectively, thanks to lower import bills and expansion of services sector. However, real GDP growth in resource-rich countries will remain subdued at 2.8%, down on previous year, but it may rebound in 2024 at 3%, below the rate of growth in 2021 (3.7%), according to World Bank. Subdued growth is attributed to faltering commodity prices (as global demand slows down), thus reflecting heavy dependency on the extractive sector.

The region’s prospects are tied firmly to global economic conditions and socio-political stability in individual countries.

The full report by economist Moin Siddiqi, 'Multiple shocks abruptly halt Africa’s steady recovery', will be published in the upcoming December-January issue of African Review.