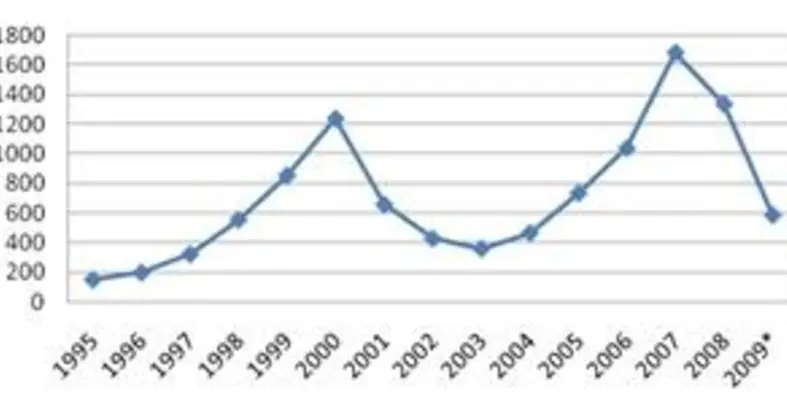

International mergers and acquisitions are forecast to decline by 56 per cent in 2009 compared with 2008, the largest year-on-year decline since 1995.

This estimate is based on OECD analysis of data for international M&A activity up to 26 November 2009. The full report is available at www.oecd.org/dataoecd/23/50/44219992.pdf. This fall is largely due to the 60 per cent decline in value of cross-border merger and acquisitions (M&A) by firms based in the OECD area, from over US$1 trillion in 2008 to US$454bn in 2009.

However, it was also due to the first sharp declines in M&A activity into and from major emerging economies: international M&A activity by firms based in Brazil, China, India, Indonesia, Russia, and South Africa fell by 62 per cent to US$46bn in 2009 from US$121bn in 2008.M&A activity into these countries is forecast to decline by almost 40 per cent this year to just over US$80bn from just under US$140bn in 2008.Speaking at the opening of the OECD Global Forum on Investment in Paris, OECD Secretary-General Angel Gurría said that governments needed to do more to promote business investment. “Against the backdrop of a fragile global economy and sharp declines in international investment activity that have now spread to the emerging economies, the international investment policy community cannot afford to relax,” Mr Gurría said. “Investment protectionism poses a grave risk to recovery by further reducing international investment flows just at a time when these are most needed. Global challenges also require investment on a scale that far exceeds available public resources. Business investment is an essential part of the solution,” he added.These latest international investment estimates suggest that total foreign direct investment into the 30 OECD countries will fall to US$600bn in 2009 from a 2008 total of US$1.02 trillion.