Africas conflicting trends reflect wider uncertainty

Despite the euro crisis threatening to spread to Spain and Italy – no bail out conceivable for that pair – the single regional currency struggles on, with little hope of regaining its late-2009 value within our review period. Another costly hike in interest rates seems to be what is propping it up and day-to-day fluctuations are considerable; for stability we recommend staying away from this unit if you have a choice. Which of course nationals of the CFA Zone don't, although their export competitiveness to US dollar markets is benefiting.

Apart from holders of gold, the biggest winners in the current turmoil have been dealers in the Swiss franc which has put on extraordinary strength against the dollar over the last month. Its that 'refuge currency' tag that has helped there; beware of exceptionally low short-term interest rates in the Swiss money markets. And a none too dazzling performance from stocks and shares either.

Apart from here in SSA, elsewhere the only real signs of significant economic growth continue to come from the USA where interest rates remain on the floor. Beware of the impact of those colossal current account and trade deficits; should the Chinese change their policy on filling these gaps the dollar could tumble. But there's no sign of that, and meanwhile Beijing carries on with its quiet policy of allowing its currency to rise, making exports of just about every manufactured item to Africa that little bit more difficult.

Don't expect anything dramatic to happen in the dollar/pound rate over the next 12 months, either. That has been remarkably steady since the end of last year on account of the similar approaches of the two central banks to controlling the cost of money.

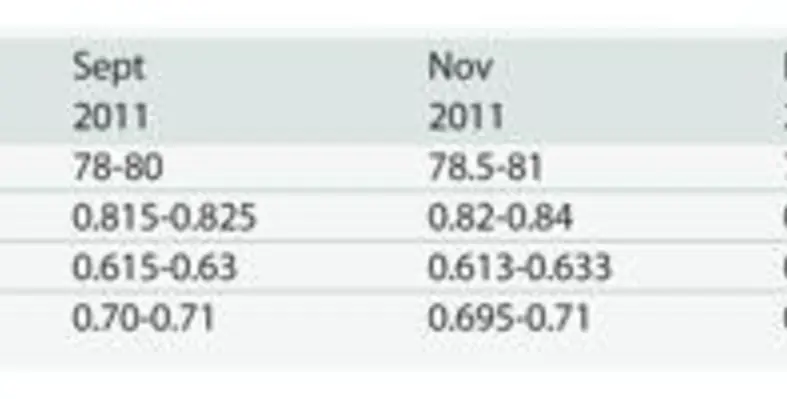

Conflicting trends have been noted with rates in Africa. The rand has fallen sharply against the dollar, boosting the essential competitiveness of hard and soft commodities and manufactures, but the sub-region's currency remains much harder than it was throughout 2010, and that combination of stagnation, inflation and high unemployment remain serious concerns. Ghana's unit seems to be reflecting the effects of the oil boom at last, but a serious contender for Africa's currency crown as July matures must be Mozambique's metical, which is now stronger than it has been for years. A small but particularly well run, and internationally supported, economy seems to be the cause.