African Reviews economist Moin Siddiqi looks at how pan-African banks are now filling the gap Western banks once held across the continent

In the decade since the global financial crisis, Africa has witnessed a rapid expansion of cross-border banking, led by indigenous groups that are spearheading the expansion of financial services and economic integration. This, in turn, is helping to unlock the region’s growth potential. The rise of pan-African banking fits Tony Elumelu, chairman United Bank for Africa vision of “Africapitalism” – shrewd far-reaching, homegrown businesses can drive future development.

The ‘pan-African banks’ (PABs) are the most efficient institutions in sub-Saharan Africa’s financial industry – combining the best of both worlds: global edges of foreign banks and competitive home edges of local banks. After the departure of most Western groups due to tightened regulation and higher capital requirements in respective jurisdictions, PABs are now leading players, overtaking Western rivals, which had dominated banking since the colonial era.

British banks led by Barclays and Standard Chartered have focused on English-speaking countries, while Francophone and Lusophone countries were dominated by French and Portuguese banks – namely Société Génerale and Banco Comercial Portugues. Citigroup (US) and Bank of Baroda (India) maintain smaller operations. In 2016, Barclays divested its 62 per cent share in Barclays Africa Group, which controlled banks in 10 African countries.

In 2016/17, most Western banks had terminated correspondent banking (CB) relationships with several African banks as a further sign of ‘de-risking’. CB is critical in the global payments system by enabling cross-border transactions and access to credit lines for foreign trade, deposit taking and placements. However, PABs quickly filled the gap by establishing CB relationships with local affected banks – thus mitigating the impact of de-risking trend by Western groups.

There are two main factors underpinning the growth of PABs. First, new technology makes it possible to operate on a ‘continental scale’ whereby regional banks can design products and process data centrally, delivering services in places with no physical branches. For example, Ecobank’s mobile app, which lets people open accounts on their phones, has attracted more than five million users since its launch in 2016. Secondly, rising intra-regional trade flows plus expansion of businesses into new SSA markets induced banks to follow their clients abroad. A study by US Boston Consulting Group found that top 30 African companies operate in an average of 16 countries, twice as many as a decade ago.

Major pan-African Groups

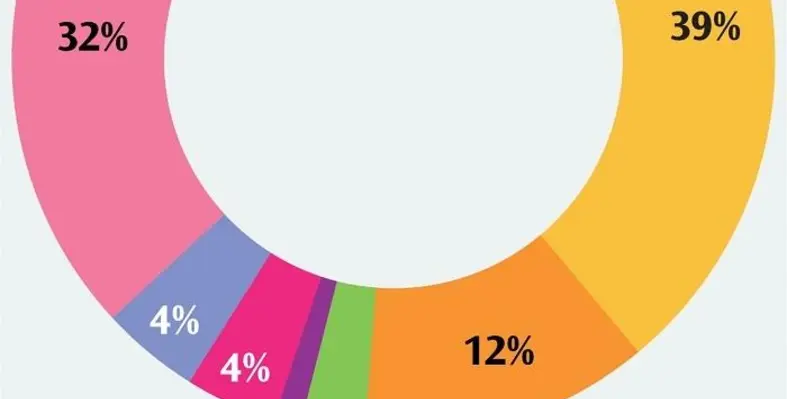

The number of PABs has increased noticeably in recent years with ten indigenous groups dominating African banking. The largest representation is from Nigeria (nine); Kenya (seven); South Africa (four); Morocco (three); and two each from Togo, Mauritius, Angola and Cameroon, respectively. Togo-based Ecobank Transnational has the highest geographical coverage (33 SSA countries), while Standard Bank (South Africa) remains the largest group by consolidated assets, with a presence in 20 countries.

Other big names include Attijariwafa, BMCE/Bank of Africa (BOA) from Morocco operating in Francophone west and central Africa, Nigerian-owned United Bank for Africa (UBA) and FirstRand (SA). UBA wants to make half its profits from intra-African business by 2022. The newcomers on expansion drive are Logos-based Zenith Bank, Diamond Bank and Guaranty Trust Bank, Kenya Commercial Bank and Oragroup (Togo) owned by private equity firm Emerging Capital Partners. Since 2016, however, PABs expansion has stalled largely due to regional growth slowdown.

The subsidiaries of Ecobank, Standard Bank, Attijariwafa, and BMCE/BOA are systemically important in their host countries measured by deposit-and-asset shares. An International Monetary Fund study revealed that 14 PAB groups held one-tenth of total deposits in 33 SSA counties, with their asset share exceeding 7 per cent of gross domestic product in 22 countries by the end of 2015.

Overall, PABs are now far more important in SSA than long-established European and US banks. Kenyan banks have used their IT edge, notably mobile banking, to push into East Africa. Nigerian lenders (after consolidation in mid-2000s) have emerged heftier and more profitable, with capital to invest abroad. In West Africa, major PABs account for 40 per cent of deposits in most countries.

PABs have expanded mainly through subsidiaries, via acquisition of existing banks operating under the hosts’ rules and regulations. Ecobank and Standard Bank have pursued such expansion strategy in recent years. Few others like UBA have set up new entities (i.e. greenfield investment). The number of regional subsidiaries of African banks has more than tripled. As of 2015, 14 PABs had a total of 169 subsidiaries across the continent, up from 53 in 2006 (IMF data).

See full report in the next issue of African Review