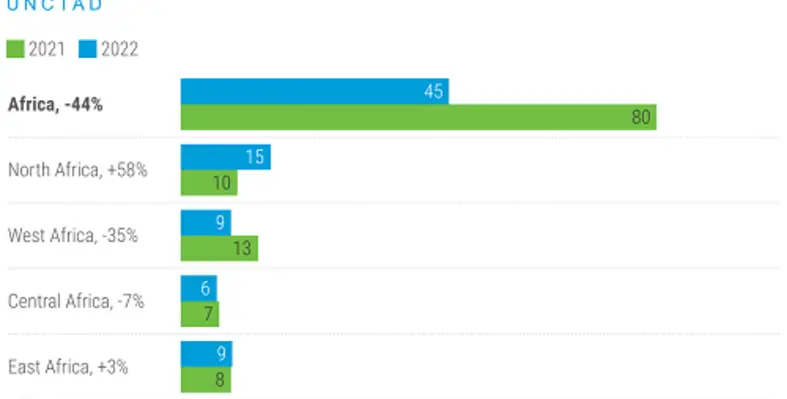

UNCTAD’s World Investment Report 2023 has indicated that foreign direct investment (FDI) flows to Africa declined to US$45bn in 2022 from US$80bn in 2021

The report has shown that the number of greenfield project announcements rose by 39% to 766 with six of the top 15 greenfield investment megaprojects announced in 2022 were in the continent.

In North Africa, Egypt saw FDI more than double to US$11bn. This was the result of increased cross-border merger and acquisition (M&A) sales. In the region, announced greenfield projects more than doubled to 161 while international project finance deals rose to US$24bn. Flows to Morocco decreased slightly, by 6%.

Elsewhere, in East Africa, flows to Ethiopia decreased by 14% to US$3.7bn although the country remained the second largest FDI recipient on the continent. FDI to Uganda grew by 39% to US$1.5bn on investment in extractive industries while FDI to Tanzania increased by 8% to US$1.1bn.

Highlights from West Africa included Nigeria FDI flows turning negative to -US$187mn as a result of equity divestments. Announced greenfield projects, however, rose by 24% to US$2bn. Flows to Senegal remained at US$2.6bn while FDI flows to Ghana fell by 39% to US$1.5bn.

In Central Africa, FDI in the Democratic Republic of the Congo remained flat at US$1.8bn, with investment sustained by flows to offshore oil fields and mining.

In southern Africa, flows returned to prior levels after the peak in 2021. FDI in South Africa was US$9bn – well below the 2021 level but double the average of the last decade. Cross-border M&A sales in the country reached US$4.8bn from US$280mn in 2021. In Zambia, FDI rose to US$116mn.

Over the past five years, FDI inflows have risen in four of the regional economic groupings on the continent. FDI in the Common Market for Eastern and Southern Africa grew by 14% to US$22bn. Flows also rose in the Southern African Development Community to US$10bn; the West African Economic and Monetary Union doubled to US$5.2bn; and the East African Community grew by 9% to US$3.8bn.

According to UNCTAD, intraregional investment remained relatively small, despite an increase over the past five years. In 2022, intraregional greenfield project announcements represented 15% of all projects in Africa (2% in terms of value), as compared with 13% (2% in value) in 2017.

However, looking at announced projects invested in by only African multinational enterprises, three quarters of their value remained on the continent.

In 2022, the biggest increase in announced greenfield projects was in energy and gas supply. Project values in construction and extractive industries also rose, to US$24bn and US$21bn, respectively. The information and communication sector registered the highest number of projects.

International project finance deals targeting Africa showed a decline of 47% in value but a 15% increase in project numbers, to 157.