Poor returns on equities, unpredictable movements in the high price of gold, less than satisfactory progress in the Euro zone and the returned spectre of a double-dip recession – will it affect Africa this time?

All these factors have combined to bring the US dollar up against most other currencies. We see this upside progress continuing despite the real efforts of the disaffected G20 countries to bring some order into the process mid-October. It has been the dollar that has been benefiting most, and with that the oil producing countries like Algeria and Nigeria whether they belong to OPEC or not.

Over the past month the UK's pound sterling and Japanese yen have successfully kept in close step with the world's number-one trading currency, but voices continue to be heard from the global markets that in the long term it could be the Chinese yuan that takes over. No-one other than a hard core of northern/central Europeans rates the Euro as a rival for this crown any more how the times monitored independently by this column have changed!

China responsible

The Chinese get lots of criticism, nowhere more than in SSA, but in terms of responsible currency management the “redback” has behind the scenes been steadily moving up against its green big brother for months, a move that continued in October. Within a decade there could be a brand new kid on the block. But the Euro has surprisingly been performing well too, bringing back up with it West/Central Africa's CFA Franc. We expect little further upside movement of this trend until the problems of Greece and all the fringing rest are sorted out with something more than the sticking-plaster plan that G20 (and most member of G8) are so dissatisfied with.

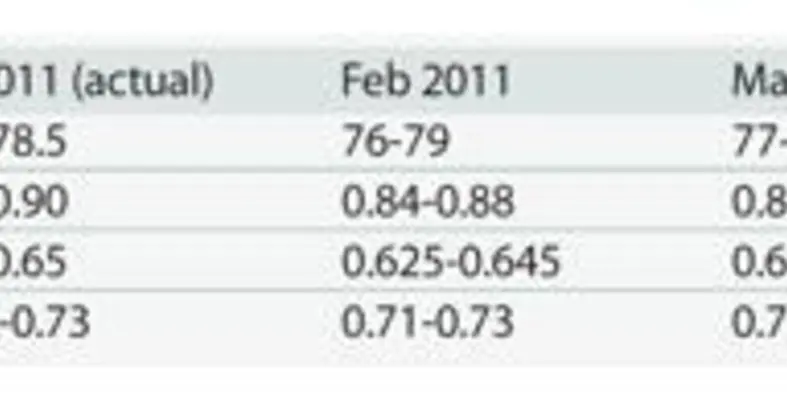

Across SSA this month the story has been dollar stability in parts, like Nigeria and Zambia, while other regional currencies have weakened substantially against the dollar. Most prominent amongst these has been the SA rand, down a very welcome five percentage points to an export-supporting level not seen since mid 2009. The EA currencies have tumbled too. If a double-dip really is on its way then these currencies like the well prepared Indians and even the Russians with their mighty oil and gas reserves will be very well positioned to weather it.

ends