This years genset report reveals 2010s winners and losers and uncovers excellent prospects for 2012

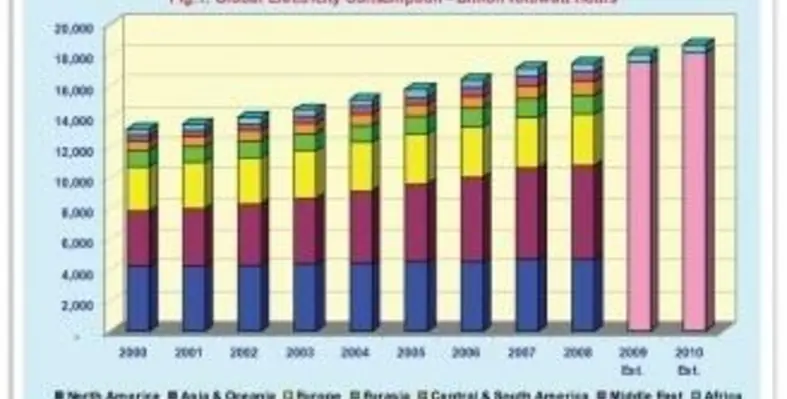

With over one billion people, 14.6 per cent of the world population, 20 per cent of the world’s land mass, it consumes only 3 per cent of the world’s production of electricity (Fig.1), and has an even smaller percentage of the global installed generating capacity.

By comparison the USA, with a population of less than one third that of Africa, consumes six and a half times more electricity in one year than the entire African continent! But despite this the majority of people living in Africa somehow survive with little or no access to electricity.

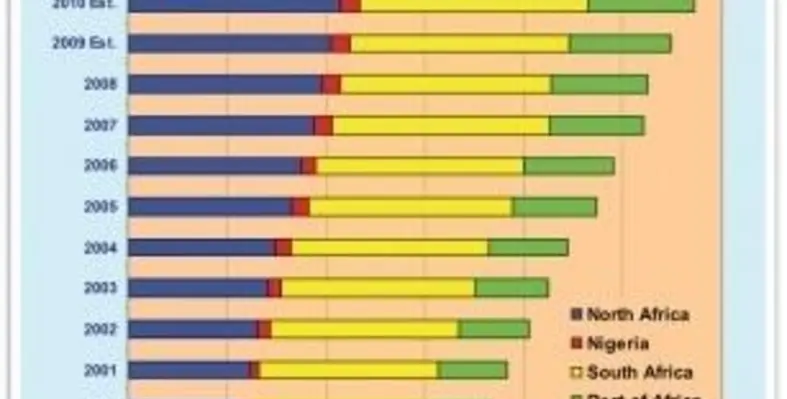

Just over three quarters of all electricity is consumed by six of Africa’s fifty-five countries which include South Africa and five countries in the North bordering the Mediterranean coastline (Fig.2). Many of the continents countries are dependent on imports of electricity from their neighbours to meet their needs.

The average per capita consumption of electricity for the entire continent is only 570 kilowatt hours per year and in twenty countries, including Somalia where severe drought has signalled famine yet again, the per capita consumption is less than 100 kilowatt hours per year.

Lack of resources

Many of the poorest nations in Africa still do not have the resources, or possibly the know-how, to bring electricity to their people via major power generation and transmission systems. It is little wonder, therefore, that the supply of diesel engine driven generating sets of all sizes in 2010 alone equated to 6 per cent of the continents installed generating capacity and was 10 per cent of global genset consumption. In some years it has been even higher.

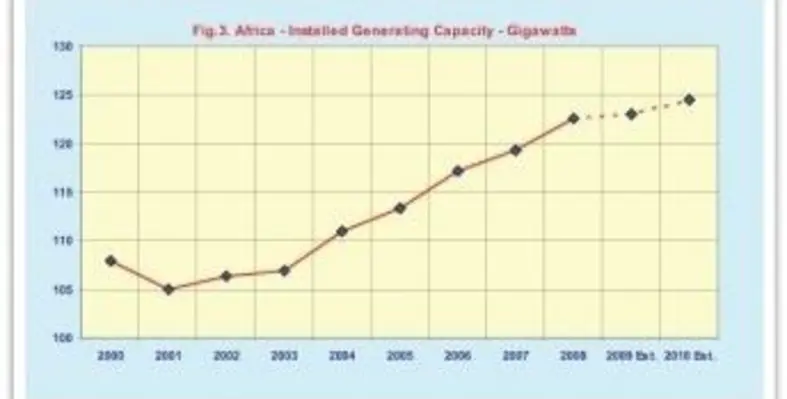

With installed generating capacity having only increased at an annual rate slightly in excess of 2 per cent for the past decade (Fig.3) the task for the future is enormous. Thermal plant accounts for almost 80 per cent of total capacity whereas hydro is only 18 per cent. Yet, whilst the continent is endowed with some of the richest water resources to satisfy the energy needs of some of its countries, and the potential to export energy to others, these remain relatively untapped. Rivers such as the Congo, the Nile, Zambezi, Niger and the Volta hold huge reserves of potential energy.

Blackouts are a routine occurrence in many countries and in others the load factor i.e. the effective utilisation of major generating plant, is well below international standards. Probably as many as 80 per cent of Africans, and in some countries even more, do not have direct access to electricity. The demand for electricity has been increasing at a compound annual rate of 4.4 per cent for the last decade, and this rate will need to increase substantially in the future if the continents political and economic ambitions are to be realised. Presently it is not forecast to increase by more than 5 per cent per annum in the foreseeable future.

Steady demand

It is of little surprise, therefore, that the trend in demand for diesel powered generating plant of all capacities has been rising at the steady rate of 17.5 per cent per annum for the past ten years, and even more for a couple of frenetic years in 2007/08 when supply was in danger of exceeding demand (Fig.4).

In 1995 Africa was only consuming 3.5 per cent of the world demand for reciprocating engine driven generating sets. By the year 2000 this had risen to 4.8 per cent, then 6.9 per cent in 2005 and now 9.6 per cent in 2010 i.e. its share of global exports has doubled in the last ten years years; very different to the days when the author was producing a limited range of generating sets in Central and East Africa in the late 1960’s!

If little is done to accelerate Africa’s installed generating capacity and distribution networks during this decade it is quite feasible that by 2020 the continent could be consuming half a million generating sets each year (instead of 101,000 now) having an aggregate generating capacity of 40,000 megawatts! The solution is likely to lie somewhere in between as major consumers become connected to more reliable power supplies and distribution systems, and rural areas move towards combinations of renewable energy, which are at present negligible i.e. photovoltaics, biomass, wind energy, micro hydro-electric & geothermal systems, as well as yet more engine driven generating plant.

African consumption

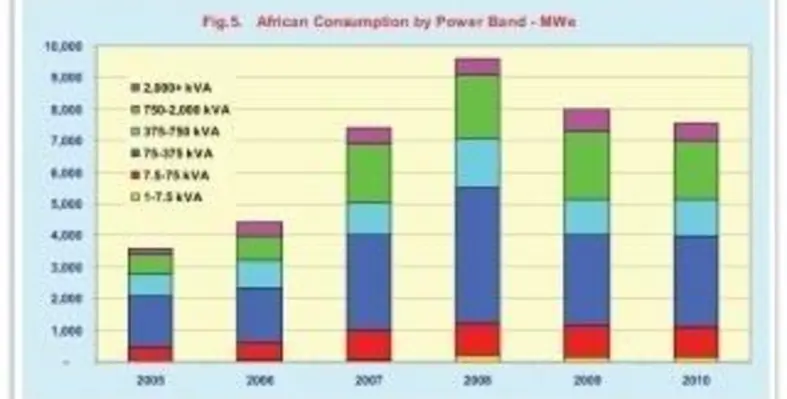

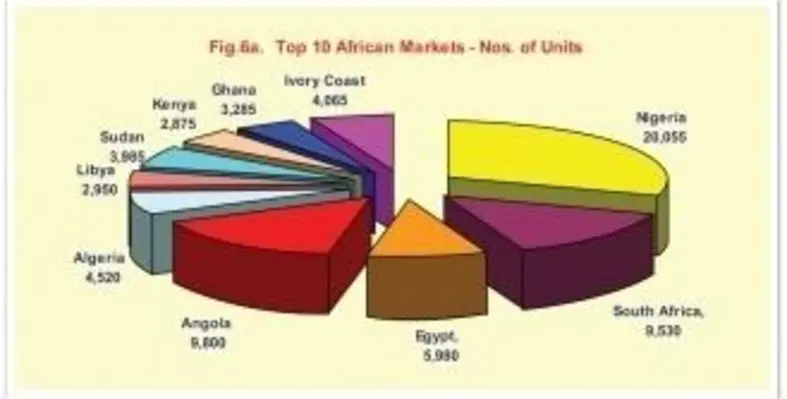

In 2010 finally adjusted statistical data confirms that Africa consumed 101,000 generating sets with an aggregate generating capacity of 7,545 megawatts (Fig.5.). Of the fifty-four countries involved the five largest consumers – Nigeria, South Africa, Egypt, Angola and Algeria accounted for 58 per cent and the top ten 73 per cent; the forty smallest consuming nations taking only 19 per cent of the total.

Nigeria, with a population of 158 million, where official statistics show that electricity consumption has been growing at 8 per cent per annum over the last five years, is by far the largest African market for diesel generating plant. This is not surprising when the average electricity consumption per head of population is less than 150 kilowatt hours each year. The market grew substantially during the last decade, despite having been of modest size in the early/mid 1990’s. By 2005 the country was consuming 8,600 sets a year having a generating capacity of 1,170 MWe. But the market ‘took off’ in 2007 reaching an unsustainable peak of 31,000 sets in 2008, almost 8,000 of which had an output of less than 7.5 kVA – only to fall back in 2009/10 to 20,000 units with an aggregate generating capacity of 1,500 MWe. As a result the underlying annual growth rate for the past five years has been only 4 per cent. However, if one accepts the general trend over the past decade it should resume to it’s more traditional level of 15 per cent annually given the severe power shortages that presently exist. Whilst the goals of the Nigerian Electricty Regulatory Commission to provide a constant, affordable and reliable power supply covering a wide national footprint to maximise the access to electricity in Nigeria may be fine, the future for the generating set industry looks bright.

South Africa

By comparison with Nigeria, South Africa, the second largest genset market in Africa, is the biggest generator of electricity on the continent – almost twice that of Egypt - and one of the world’s top twenty generators, as well as an exporter of power to neighbouring African countries. However, the load factor of its generating plant is very high. Official statistics for the consumption of electricity can be misleading because they show only a growth rate in the order of 2 per cent per year over the last decade. Whilst the cost of electricity in South Africa has been relatively low, economic growth in recent years has caused demand to outstrip supply, thereby creating a considerable market for generating sets, which during the past fifteen years has increased tenfold.

South Africa consumed an aggregate of 940 megawatts of engine driven generating sets in 2010. Whilst the market had been growing steadily at a rate of 22 per cent per year until 2006, it then grew to an unsustainable level in 2007/08, only to fall back substantially in 2009/10. The underlying growth level is more likely to be in the order of 20 per cent given Eskom’s plans for increased generating capacity, some of which has already come on stream. Sixty per cent of demand lies in the range from 75/375 kVA and a further 30 per cent from 375 to 2,000 kVA.

Today South Africa is a major producer of generating sets, and the only country in Africa producing more than it imports. Production has more than trebled in the last four years; almost 9,000 units in 2010 with an aggregate generating capacity of 1,100 MWe. Imports are down from 13,000 gensets in 2008 to 4,965 last year; with exports to neighbouring African States increasing to just over 4,000 units. It is quite feasible that by 2013 domestic consumption will have reached 17,500 units with an aggregate generating capacity of 1,700 MWe.

North Africa

Both Egypt and Algeria are among Africa’s top five generating set markets. When taken collectively with the other North African states of Morocco, Libya and Tunisia, they accounted for 16 per cent of the volume and 26 per cent of the electrical capacity of Africa’s generating set consumption in 2010. But four of these markets are now experiencing both economic and political instability, so the short term prospects for North Africa are not promising. Tunisia needs a financial helping hand as economic growth last year at nearly 4 per cent is forecast to fall to 1 per cent this year. With a population of 10.6 million electricity consumption had been growing at 5 per cent per annum over the past decade. Together with Algeria, the main source of supply, Tunisia has been sending small overland shipments of oil to an embattled Libya, who with a population of 6.5 million was the fourth largest consumer of electricity in Africa. But in the short to medium term everything has changed politically, possibly with the exception of Morocco where a new constitution has bought some time before general elections are expected later this year.

Egypt, the third largest genset market in Africa, having a population of 80 million and consuming 12 per cent of the continents annual genset demand, is also the second highest consumer of electricity in Africa which has grown at a compound rate of 7 per cent per annum for the past ten years. Egypt is the worlds 41st biggest economy, but the Mubarak regime has been an unmitigated calamity, mainly because they were incapable of delivering proper standards of living to the vast majority of the Egyptian people. However, inspired by the Tunisian revolution, the Egyptian uprising earlier this year has changed the economic dynamics in the short to medium term.

Disruption

This has led to the temporary disruption of economic activity and below-capacity production. GDP growth is unlikely to remain at the 2010 level of 5 per cent when the government invested in infrastructure and public projects, or 7 per cent prior to the financial recession, but is more likely to be in the order of 2 per cent. The budget deficit is also forecast to rise to a level of 10 per cent. Since imports still dominate domestic consumption this points to a reduced demand for generating plant in 2011, and possibly beyond. Apart from a dip in demand in 2009 the underlying growth trend for the past five years had been 19 per cent per annum, reaching a peak of almost 1,000 MWe in 2010. Political stability, and a need to reboot its long stagnant economy will be essential if Egypt is to return to this level of growth in the future.

Angola became the largest crude oil producer in Africa in 2009, surpassing Nigeria. Oil production and its infrastructure support around 85 per cent of GDP, and its growth rate in recent years has been driven by the high international price for oil. This has also been reflected in the demand for generating sets where the overall growth has averaged over 35 per cent per year since 2005, when the market more than trebled, before flattening off in 2009 and then declining in 2010; the recession having temporarily stalled economic growth. Whilst the market consumed 15,000 gensets in 2008, ten times more than in 2005, and is now averaging 10,000 units per annum with an aggregate output of 500 MWe, it is set to resume substantial growth in the future. This is reflected in the consumption of electricity in Angola which, over the past five years has risen at an annual rate of 15 per cent, driven by a population of 19 million people having an average per capita consumption of slightly less than 250 kilowatt hours per year.

Market doubles

Algeria, the fifth largest generating set market, is the fourth largest crude oil producer in Africa after Nigeria, Angola and Libya. It also has the eighth-largest reserves of natural gas in the world and the consumption of electricity continues to grow at a rate of over 5.5 per cent per annum. Whilst the state still dominates a substantial part of the economy the market for generating sets has almost doubled in the past five years, though not surprisingly 2010 saw a forty per cent fall in the market after years of continual growth. The market presently consumes 4,500 gensets each year, down from the peak of 5,700 in 2009 when 70 per cent were of a rating in excess of 375 kVA. Despite this the underlying growth rate at 18.5 per cent is positive, and once political and economic stability have been fully resolved the market should return to a positive pattern of growth.

In 2010 these top five markets consumed nearly 50,000 generating sets, slightly less than half of the African total with an aggregate generating capacity of 4,340 MWe; 58 per cent of the continents total. The next five markets, Libya, Sudan, Kenya, Ghana and the Ivory Coast consumed 17,160 gensets with an aggregate capacity of 1,145 MWe, 15 per cent of the total market (Fig.6). Over a five year period since 2005 there has been very little change in the per centage share of the top 10 countries and the rest of the market i.e. 73:27 vs. 75:25 in 2005. The major difference is that the average output per unit has been increasing at a considerably faster rate in the former markets than in the latter. The average rating per unit today of 100 kVA is one third higher in the top 10 markets than for the rest. The fastest growth in demand has been for generating plant in the range 750-2,000 kVA where it has averaged 22 per cent per year for the past decade, followed by the 7.5-75 kVA band at 17.5 per cent.

Libya forecasts

The Libyan economy depends primarily upon revenues from the oil sector, which contribute about 95 per cent of export earnings, 25 per cent of GDP, and 80 per cent of government revenue. As Europe’s single largest oil supplier, the second largest oil producer in Africa and the continent’s fourth largest gas supplier, Libya dominated the petroleum sector in the Southern Mediterranean area. Its generating set market peaked dramatically in 2009, only to fall back in 2010 to 3,000 units with a generating capacity of 320 MWe. When revolution broke out in the Arab world, few expected it to reach Libya, but the effects of the revolution are now affecting trade seriously, so forecasts for 2011 have been seriously scaled back.

Sudan

Sudan's real GDP expanded by 5.2 per cent during 2010, an improvement over 2009's 4.2 per cent growth, since when South Sudan has become the 55th independent, but landlocked, nation. With a total population of 44 million prior to independence, the per capita consumption of electricity in Sudan was only slightly in excess of 100 kilowatt hours per person. The majority of the population exist on subsistence agriculture, and both industry and infrastructure in landlocked South Sudan are severely underdeveloped. However, South Sudan does produce nearly three quarters of the former Sudan's total oil output of nearly a half million barrels per day which is exported through two pipelines that run to refineries and shipping facilities at Port Sudan on the Red Sea. The genset market reached its peak in 2008 when demand was nearly 6,000 units with a capacity of 540 MWe but has declined ever since to 4,000 sets in 2010 with a generating capacity of 310 MWe. In the short term the economy of South Sudan is likely to remain linked to that of Sudan, but there is unlikely to be any growth in the short term for generating plant in either of these two markets.

Kenya, Ghana and the Ivory Coast

The final three of Africa’s Top-10 genset markets, Kenya, Ghana and the Ivory Coast each consumed between 150- 200 MWe in 2010. However the underlying growth rate in each of these markets is in excess of 25 per cent per year. The Ivory Coast in particular grew in 2009, then ‘took-off’ in 2010, consuming 4,100 gensets having a generating capacity of 150 MWe. Kenya, though a somewhat larger market experienced more steady growth with an emphasis on larger units in the range 750-2,000 kVA.

A synopsis of the demand in 2010 for the 10 leading markets is shown in Fig.7.a. & 7.b. However, the forecast for 2011 is not overly optimistic, for whilst the political and economic uncertainty in North Africa remains it is bound to have a negative effect on generating set demand. Whilst Tunisia had an economic growth of 4 per cent last year it is unlikely to exceed 1 per cent in 2011. In Libya, the sixth largest African market the situation is even worse. Whilst in the east they begin to build an independent economy, in Tripoli the future remains less clear. The production of oil is vital in the east if a much needed source of income is to become available to finance future trade. And in Egypt the third largest market, the country waits on the Generals and the autumn election for a new government to determine future economic strategy. Because of this it is unlikely that African demand will increase by more than 5 per cent in 2011 to 7,900 MWe - approximately 106,000 diesel generating sets valued at $1.3 billion. By 2015 this could rise to between 12-14,000 MWe.

A synopsis of the demand in 2010 for the 10 leading markets is shown in Fig.7.a. & 7.b. However, the forecast for 2011 is not overly optimistic, for whilst the political and economic uncertainty in North Africa remains it is bound to have a negative effect on generating set demand. Whilst Tunisia had an economic growth of 4 per cent last year it is unlikely to exceed 1 per cent in 2011. In Libya, the sixth largest African market the situation is even worse. Whilst in the east they begin to build an independent economy, in Tripoli the future remains less clear. The production of oil is vital in the east if a much needed source of income is to become available to finance future trade. And in Egypt the third largest market, the country waits on the Generals and the autumn election for a new government to determine future economic strategy. Because of this it is unlikely that African demand will increase by more than 5 per cent in 2011 to 7,900 MWe - approximately 106,000 diesel generating sets valued at $1.3 billion. By 2015 this could rise to between 12-14,000 MWe.

Bounding ahead

If the ten largest generating set consumers - who account for 73 per cent of genset demand, 79 per cent of all electricity consumption and have 77 per cent of the continents installed generating capacity – continue at their present rate of growth, it is questionable how the remaining 45 countries will ever catch up with them. At present the average electricity consumption per capital for these ten countries is approaching 1,000 kilowatt hours per year, 4.3 times more than for the rest of Africa. This requires immense investment in new generating plant; approximately an additional 75 per cent of Africa’s current installed plant capacity – and that is just to catch up !! There lies the “Dilemma and the Challenge”; the challenge to the generating set and renewable energy industries to respond to the needs of the people in remote areas which transmission lines are unlikely to reach in the foreseeable future and where the ability to provide clean water, irrigate crops, refrigerate medicines, power small scale industry etc., can change lives dramatically.

Copyright: Gerald Parkinson © 2011

Acknowledgements: Data for this article is provided from GENSTAT, a definitive database analysing the worldwide market for generating sets in 12 bands for over 200 countries. For more information contact George Williamson at Parkinson Associates - Tel. 01452 534 388 or e-mail