Economist Moin Siddiqi explores some of Africa’s mega-projects underway or in the pipeline that would provide a major uplift for sub-Saharan Africa in the coming decade

Africa is the world’s second largest and second most populous continent. It covers one-fifth of globe’s total land area, and the current population (1.2bn) is projected to reach 2.6 billion by 2050 (UN forecast). But as economies grow, infrastructure investments lag behind needs. To cope with increased demand for goods and services, sizeable funds are required to build and maintain roads, bridges, ports, railways, dams, power grids – including clean energy solutions such as solar panels – as well as social housing and health services.

Harihuko Knoda, former President of the Asian Development Bank, said, “Without appropriate infrastructure, countless millions of people will lack access to jobs, markets, hospitals and schools.” Weak infrastructure costs Africa an estimated two per cent of gross domestic product (GDP) annually, while hindering intra-regional trade and foreign direct investment (FDI). Good systems, in terms of energy/transport, foster competition, innovation and productivity.

According to global consultancy firm Deloitte a dollar of infrastructure investment can raise GDP by 20 cents over the long term by boosting productivity. The World Bank also estimated that a one per cent hike in capital stock increases the nation’s GDP by one per cent. Further, higher spending on transport lowers transaction costs by improving connectivity within national boundaries and across borders.

Tackling the infrastructure deficit

Growth-enhancing public capital expenditure is Africa’s top priority, as its regional rating on global infrastructure development index lags behind peer developing regions. Less than two-fifths of subSaharanAfricans have electricity, and Internet penetration rate falls below one-tenth. Just 56 per cent have access to clean drinking water and about three-fifths of Africans lack basic sanitation facilities.

Barely a quarter of Africa’s road network is paved, while a third of Africans in rural areas live within 2km of an all-season road, compared with two-thirds of the population in other developing regions. Inefficient port facilities add 30-40 per cent to intra-regional trading costs – among the highest in the world.

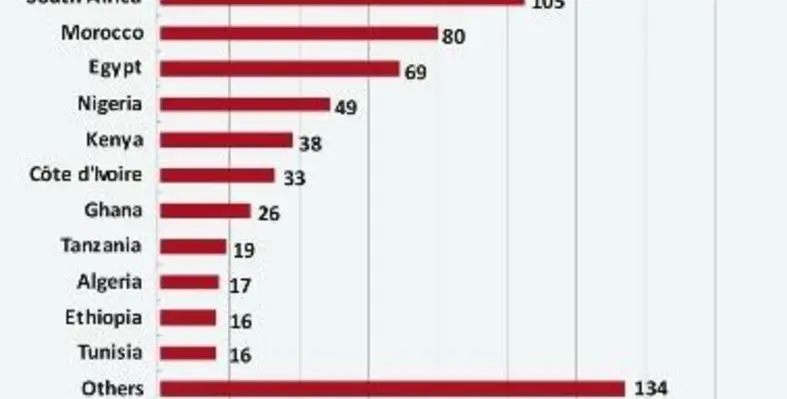

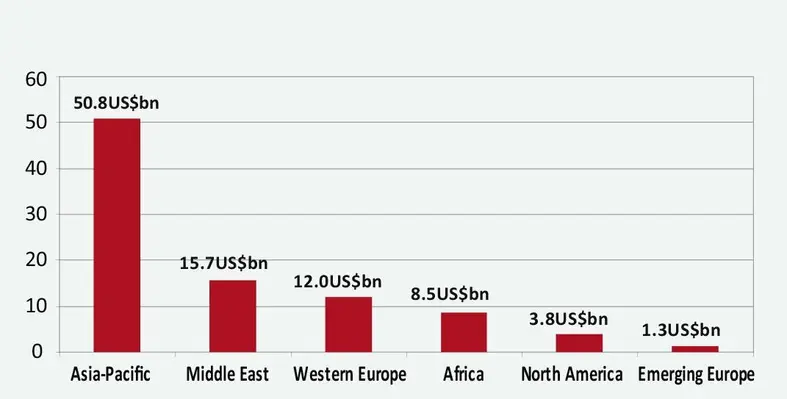

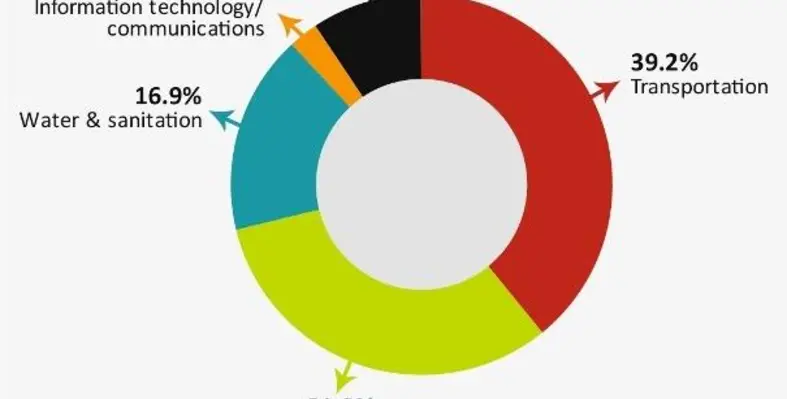

There is no easy fix for Africa’s well documented infrastructure backlog. The Infrastructure Consortium for Africa (ICA) reckons US$120-140bn is needed in the short-term to address the deficit. Whereas US consultancy McKinsey estimated that Africa’s infrastructure spending should double to US$150bn per year. But regional investment in four main sectors, transport, energy, water and ITC, in 2016 totalled US$62.5bn – down from US$78.9bn in 2015 (ICA data). African states invested just US$26.3bn and US$24bn, respectively, in 2016 and 2015. China remains by far the single largest investor in African infrastructure projects – spending US$12bn/year over 2011-16 (ICA data).

The African Development Bank (AfDB) projections underpin the urgency for increased investments to cope with strong demographic trends in the coming decades. Power demand in Africa will reach 700 gigawatts (GW) by 2040; transportation volumes on the continent are forecast to swell by six to eight times over the same period and even higher for 16 landlocked African countries; port throughput is projected to exceed 2bn tonnes by 2040; water pressure will rise, endangering the Nile, Niger, Orange and Volta basins; and ITC demand will multiply by a factor of 20 before 2020, as Africa catches up with worldwide broadband. At present, the actual gap in terms of financing is large.

Big obstacles

Various factors hinder infrastructure financing, including higher transaction costs, inadequate availability of “bankable” projects, the multiplicity of regulations, permits/licenses required, and the multi-governmental agencies/institutions that investors must deal with in a typical capital project. Other issues, such as the banking sector’s emphasis on short-term loans and deposits also impede medium-long/term project funding. There are also challenges related to limited local capacity for project preparation and tender, i.e. packing and structuring projects for financial, technical, legal and environmental feasibility. In reality, many projects envisioned by governments are not moving ahead.

Despite challenges, existing bottlenecks in sub-sectors offer opportunities for consultancies, project financiers and engineering, procurement and construction firms to help meet the infrastructure demand. Yet investing in African capital projects can be profitable with an average return on investment (ROI) estimated by Deloitte at 19-22 per cent – exceeding the 8-12 per cent offered in developed markets. “If people haven’t invested in the region before, they perceive more risk than there actually is,” said Adrian Mucalov, director energy business at Actis, an emerging markets investor with a portfiolio worth US$5.5bn spread across Africa.

In sum, regional governments need to provide an enabling environment for infrastructure investment, including through building appropriate institutions and legal/ regulatory frameworks. In order to entice strategic partners, it is critical to lower transaction costs payable by investors and financiers. Most countries must look at developing basic infrastructure, and financing it. Public-private partnerships (PPPs) hold the key to future development of Africa where three-fifths of Africa’s population still lack access to basic public services, which hinders efforts toward achieving UN Sustainable Development Goals and structural transformation in Africa. To end on a positive note: infrastructure spending in Africa as a percentage of total emerging market capital spending is expected to increase from 2.1 per cent in 2000-15 to 3.4 per cent between 2016 and 2030, according to Deloitte.