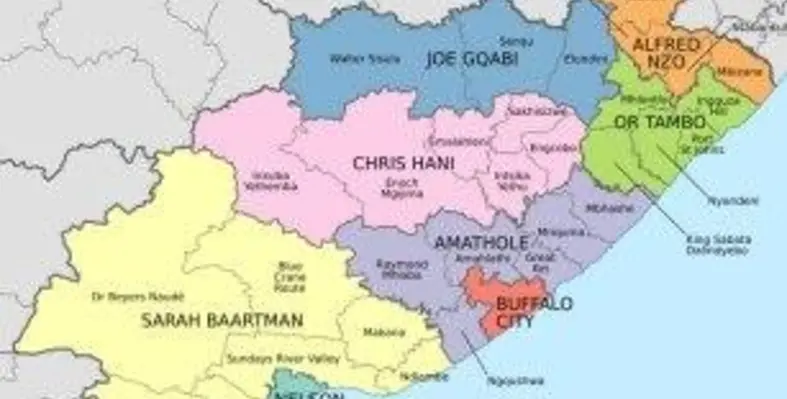

Map of the municipalities in the Eastern Cape province of South Africa, with all municipalities named and district municipalities shaded different colours. (Image source: Htonl/Commons)

Vulindlela, the new industrial park, is the second industrial park to be launched in the Eastern Cape in South Africa