While the developed world still faces years of economic stagnation and further deleveraging and mainstream emerging markets are seeing growth slowdown, many African countries are witnessing an economic renaissance, writes Moin Siddiqi

Dedicated frontier and Africa-focused funds range from conventional long only equity to hedge and private equity funds, which invest in diversified portfolios of securities, including local currencies, corporate debt, sovereign bonds, listed and private (unlisted) equities.

These specialised funds seek to exploit market inefficiencies by selecting undervalued and unlisted companies. Interest in African private equity (PE) has increased in the past decade, putting the region finally on global investors’ radar screen.

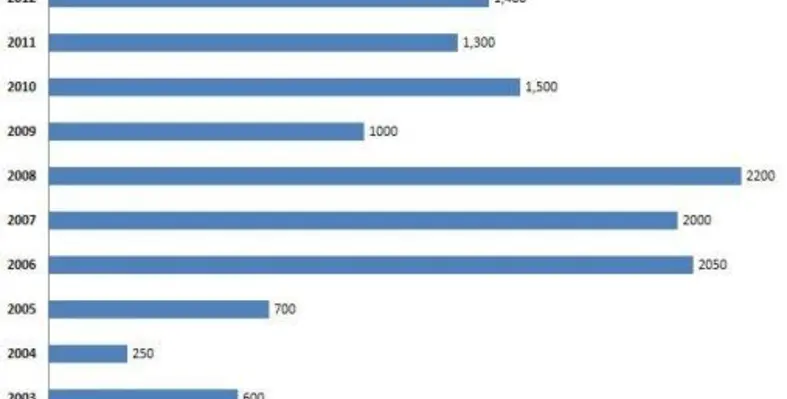

Between 2002 and 2012, about US$13.3bn was raised to invest in PE in the region, according to Emerging Markets Private Equity Association (EMPEA). However, these figures are quite modest compared to emerging Asia or South America. About US$150bn or more in PE capital was raised by the BRIC countries during that period.

The growth of purchasing power of Africa’s middle-class offers opportunities in infrastructure, retail, financials, information and communications technologies (ICT) and healthcare. PE remains a popular outlet for fund managers to access this emerging consumer market pinned by demographic trends such as swelling youth population, growing labour forces and increasing urbanisation.

Excluding South Africa, the region’s No.1 economy, Africa’s growth is projected to average six per cent

over the 2013-15 period, according to the World Bank.

Fund managers are gradually looking beyond South Africa for deals in Kenya, Nigeria, Ghana, Tanzania, Rwanda, Botswana, Angola and Zimbabwe, among others. Few have opened regional offices to cover the markets locally since intermediary networks are still weak. Sector-specific funds appeal especially to investors targeting infrastructure, forestry and agri-businesses.

Silk Invest, London-based boutique asset manager, recently observed, "Nowadays, it is Africa that is the continent on investors’ lips. When the frontier markets story started before the crisis people actually tilted away from Africa, but these days that is where they want to go above all."

Morgan Stanley’s asset management arm agrees, "A decade ago it was the BRIC and now it is frontier markets like Africa" - drawn by attractive returns.

Profusion of funds

Among the established PE managers in sub-Saharan Africa include:

- Helios Investment Partners, which in June 2011 raised US$900mn for the largest-ever buyout fund in Africa, according to the Financial Times.

- Actis, a major PE firm with almost US$2bn invested in 15 countries. It is a major capital provider to power generation and distribution sectors.

- Aureos Capital focuses on small and medium-sized enterprises (SMEs), with a regional growth potential, as well as on ecotourism, logistics and micro-finance.

- Kingdom Zephyr, which in 2008 raised US$492mn to invest in mid-sized firms.

- Emerging Capital Partners, the pan-African investment firm that has raised more than US$2bn for investments across a range of sectors, including consumer businesses, telecommunications, financial services and agribusiness, and which operates from seven countries across the continent.

- Development Partners Int’, has invested US$500mn in nine deals.

Some other Pan-African funds active in the region are Lereko Metier Capital and Pamodzi Resources Fund, owned by Pamodzi Investment Holdings (South Africa), in collaboration with US investors led by Metals & Coal International.

Specific country funds include South African based Ethos PE and Brait PE – both were formed in 2005 and reportedly raised US$750mn and US$680mn, respectively, ABSA Capital Private Equity (South Africa) and African Capital Alliance focusing on Nigeria and Gulf of Guinea.

According to Preqin, the data provider, 57 African-focused PE funds are currently looking for US$13.1bn, half of which are based in South Africa. The prominent managers such as the US’ Carlyle Group, which last year invested US$210mn in ETG, a Tanzanian agri-commodities trader, Actis, ABSA, Ethos, Brait and EVI Capital, are reportedly seeking to raise US$750mn; US$3.5bn; US$1.7bn; US$750mn; US$700mn; and US$400mn, respectively, in new risk-capital to support their expansion in sub-Saharan Africa. Brazilian BTG Pactual, the UAE-owned Abraaj Capital and KKR Asset Management LLC are newcomers to the niche markets.

This article originally featured in the July 2013 issue of African Review of Business and Technology - click here to read the full version of the article