Overall, growth in sub-Saharan Africa (SSA), home to over 1 billion people remains at below potential in recent years because of continued external headwinds and climate shocks, such as droughts, cyclones and heavy rainfalls coupled with security tensions and slower pace of domestic reforms in some countries

Africa’s fortunes are heavily tied to global economy. The IMF in its October 2019 Regional Economic Outlook remarked, “The challenge for the region is to boost growth to create jobs for the growing labour force, while protecting against debt vulnerabilities and risk from a difficult global environment.”

The African Development Bank (AfDB) 2019 estimates for regional GDP growth at 4 per cent exceeded both figures from the World Bank and IMF at 2.6 and 3.2 per cent, respectively. Sustained anaemic growth in South Africa and Nigeria is holding the continent back. Excluding them from the calculation leaves the rest of SSA growing at a healthy pace of around 5 per cent. Regional slowdown mainly reflected weaker fixed investment and net exports.

In 2019, the manufacturing and mining industries saw a modest expansion but the services sector lost some momentum and agricultural output suffered from El Nino (i.e. severe droughts) in parts of Angola, Botswana, Ethiopia, Kenya, Zambia and Zimbabwe. While Mozambique and other southeastern countries were hit by cyclones – translating into higher inflation and lower state revenues. Feeble growth in Nigeria, South Africa and Angola with a combined GDP and population in 2018 of US$871.4bn and 284.5mn, respectively, continues to weigh on regional economic performance.

The region faces fiscal stress that could derail ‘hard-won’ progress in growth and development over the past decade. Several countries have elevated debt levels, depleting foreign exchange reserves and weaker bank balance sheets. In 2018, over two-fifths of SSA countries were in debt distress or at high risk. Government debt exceeds half of GDP in 23 countries; most heavily indebted are Angola, Congo Rep; Eritrea, Mozambique, Togo and Zambia. Elevated debt levels and low external buffers – hence limited repayment capacity – are fuelling vulnerabilities, especially as public debt stocks are shifting from official multilateral and bilateral to commercial sources.

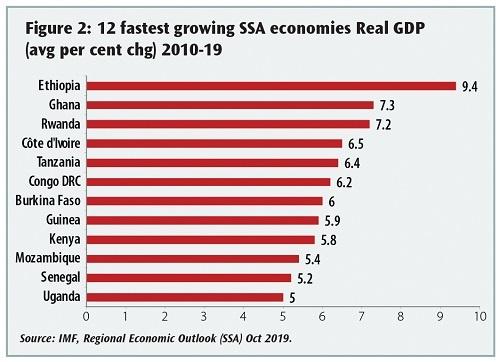

Looking ahead, regional growth is expected higher as domestic demand, plus trade volumes strengthen, supported by a gradual recovery in global economy. The IMF envisages 13 out of 45 SSA countries surging at 6 per cent or above, led by Ethiopia, Côte d’Ivoire and Rwanda – ranked as the world’s most buoyant economies. Furthermore, 4 to 5 per cent real GDP growth is predicted for 15 countries, led by Botswana, Cameroon, Ghana, Sierra Leone and Tanzania.

However, the recovery remains patchy and debt levels are high, reinforcing the need for continuation of structural reforms to boost inward investment, competitiveness and trade in the context of the African Continental Free Trade Area (AfCFTA). “The risks to the macro outlook are mostly on the downside and the recovery will remain fragile,” said Albert Zeufack, chief economist for Africa at the World Bank. The Bank expects average SSA growth at 3.1 per cent in 2020. SSA medium-term expansion (excluding Nigeria and South Africa) could exceed 5 per cent – fuelled by robust growth in services, especially retail, wholesale, communication and banking/finance, as well as construction.

By economist Moin Siddiqi