ACI Worldwide, a provider of real-time electronic payment and banking solutions, has announced that Eafricalab will use its Postillion UP Retail Payment solution to better serve consumers across 25 African countries

Eafricalab is an African processor, providing payments processing for customers across the banking, retail, microfinance, telecoms and local government sectors.

ACI’s payments platform will empower Eafricalab to modernise its payments offering, fostering further innovation and financial inclusion across the continent.

Eafricalab will utilise ACI’s UP Retail Payments solution for Postillion that provides seamless configuration and scripting, enabling the processor to quickly launch new value-added payment services for its customers, including card management, gift cards and prepaid solutions.

In addition, Postilion will allow the company to process modern electronic payments, such as non-card withdrawals, retailer transactions and new alternative payment methods.

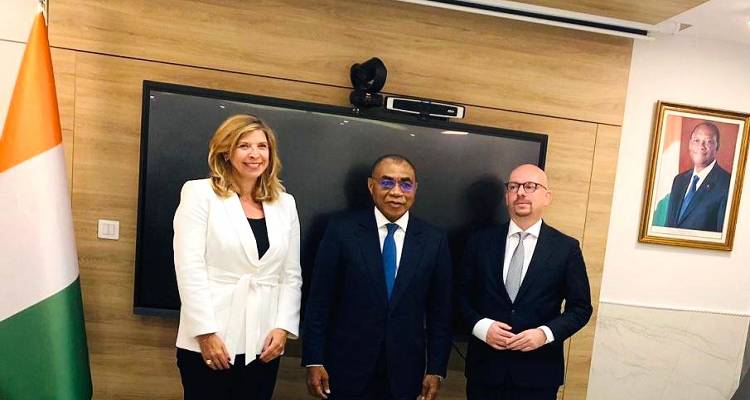

Simplice Anoh, CEO of Eafricalab, said, “We are excited to adopt ACI’s proven payments technology, which will allow us to offer new payments capabilities as well as stronger services to our clients. Together with ACI, we are committed to leading the digital payments revolution across Africa.”

Manish Patel, vice-president of Middle East, Africa and South Asia, ACI Worldwide, added, “This new partnership reaffirms our commitment of enabling rapid innovation for the African market with cutting-edge payment solutions.”

“ACI’s UP Retail Payments solution for Postillion enables new, digital payments to be offered in any marketplace, ensuring that processors, acquirers, payment card networks and banks are able to participate in the new payments ecosystem,” he concluded.